Leonbets слоты онлайн

Любите азарт? Играйте в слоты на Leonbets вращайте барабаны и увеличивайте свои шансы на джекпот.

Зеркало Leonbets 2023

Бк Леон Официальный

27.06.2023 27.06.2023 от admin

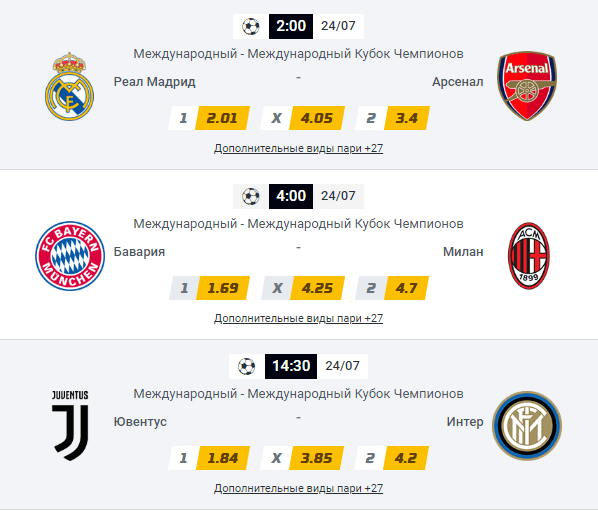

Как сделать экспресс ставку в БК Леон: правила, ограничения и расчет коэффициента Помимо ставок на ординар, популярностью пользуются экспресс-ставки. В этой статье мы расскажем, как сделать экспресс ставку на «Леоне». Также на примере покажем, как рассчитывается коэффициент, какие существуют ограничения и условия по экспресс ставкам. Что такое экспресс ставка? Экспресс-ставка (или просто экспресс) – кобминированный … Читать далее

Рубрики Регистрация LeonBets Метки букмекер, войти, Казахстан, Леон, на сегодня Оставьте комментарий

Леон Бонус Новым Игрокам

27.06.2023 27.06.2023 от admin

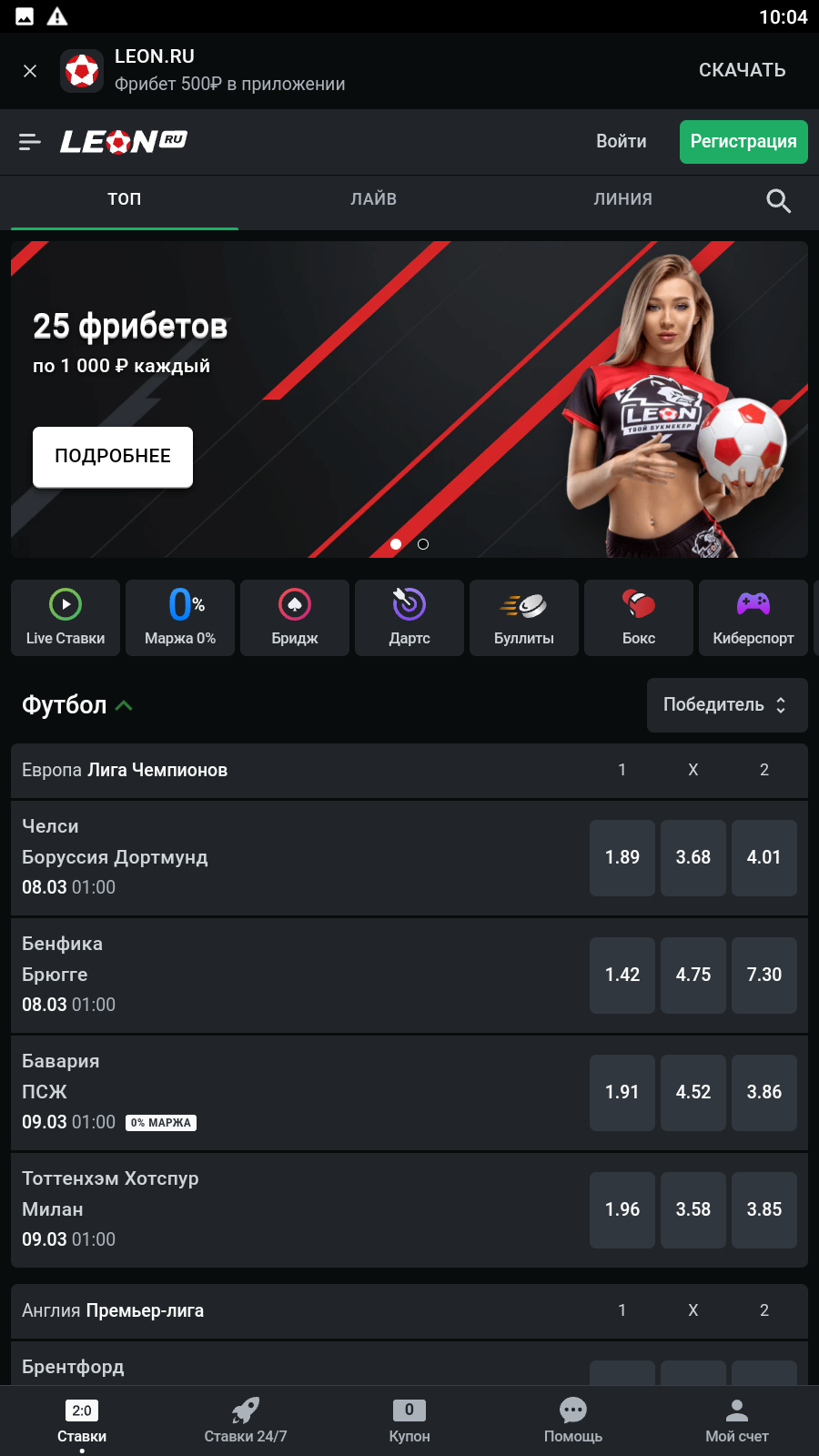

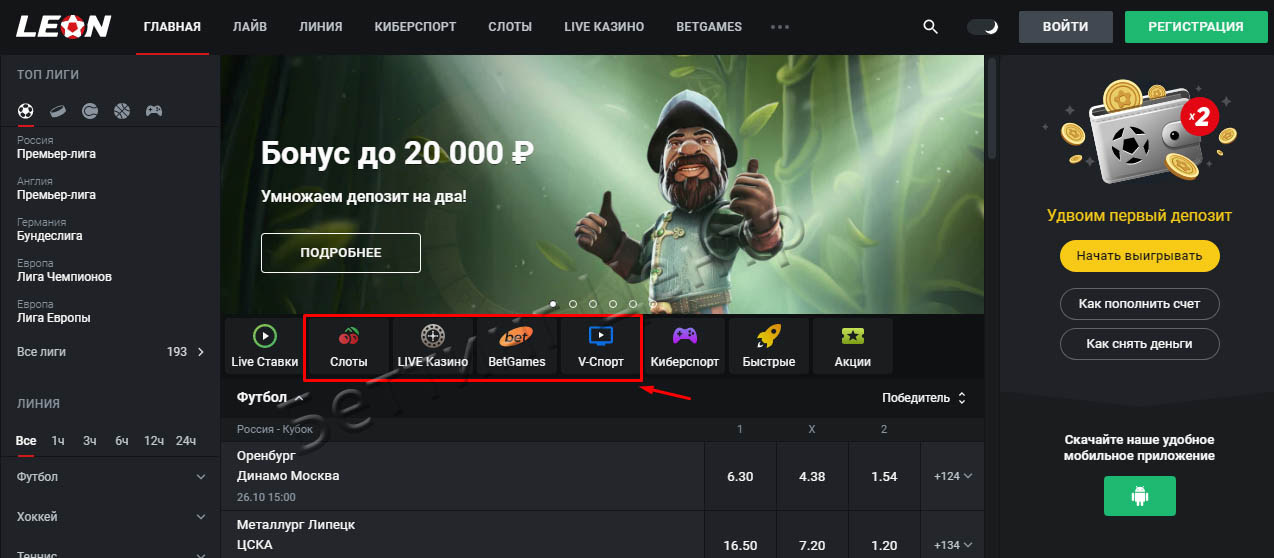

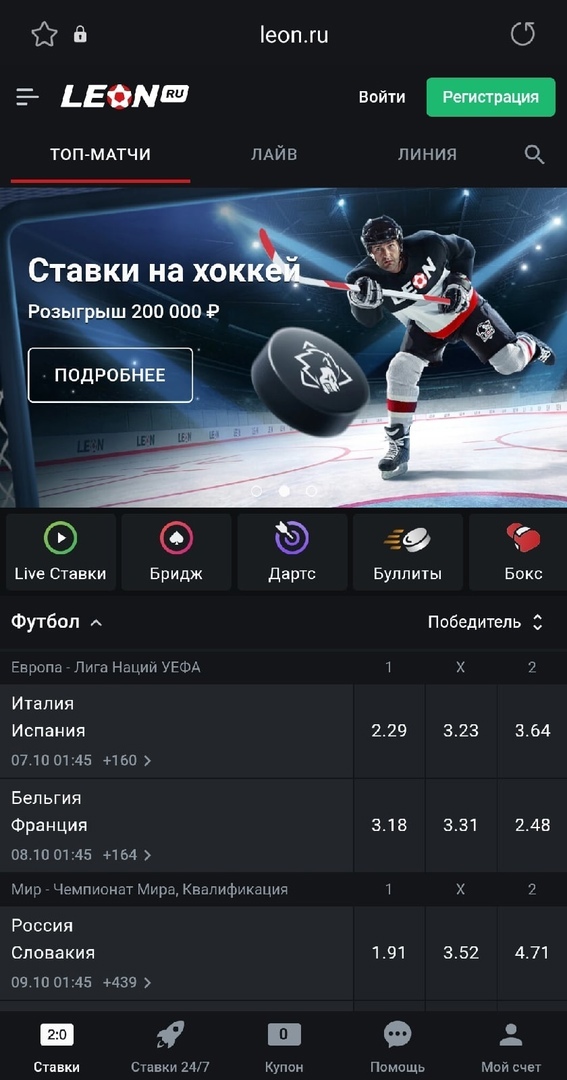

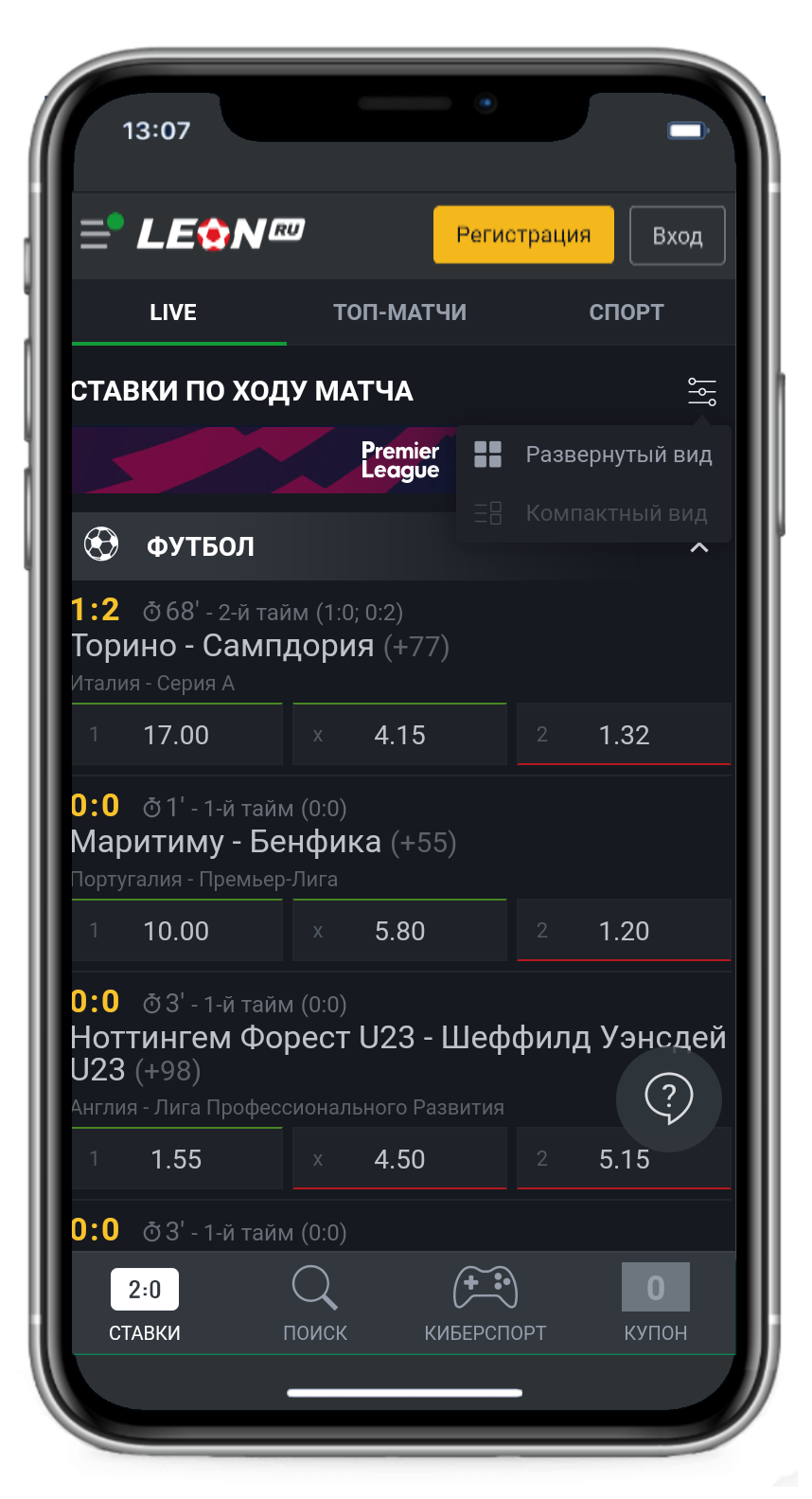

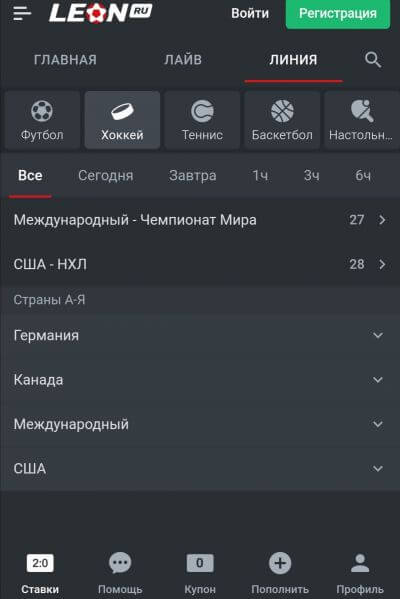

Обзор приложения БК Леон на Андроид Хотите комфортно ставить в букмекерской конторе Леон с мобильного устройства? Скачайте приложение на Андроид. Мобильный софт поддерживает полный функционал БК, работает стабильно и быстрее, чем сайт. Интерфейс приятный, а навигация и панель управления – грамотно продуманы, поэтому пари оформляются легко и быстро. Инструкция – как скачать БК Леон на … Читать далее

Бк Леон Телефон Горячей Линии

27.06.2023 27.06.2023 от admin

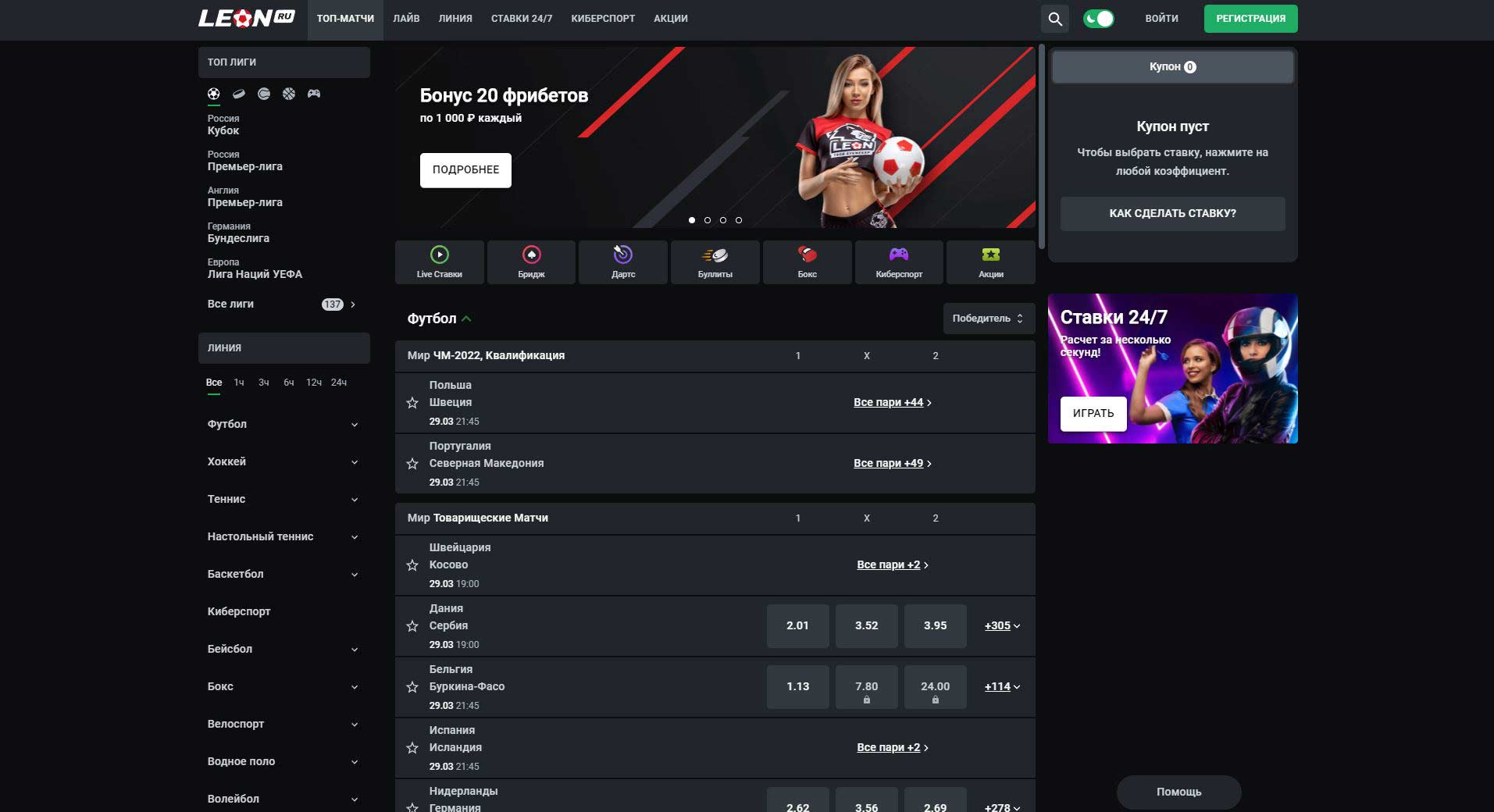

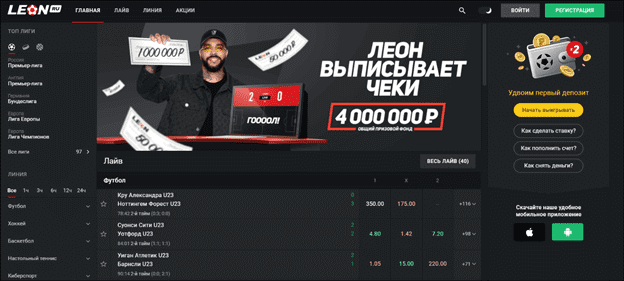

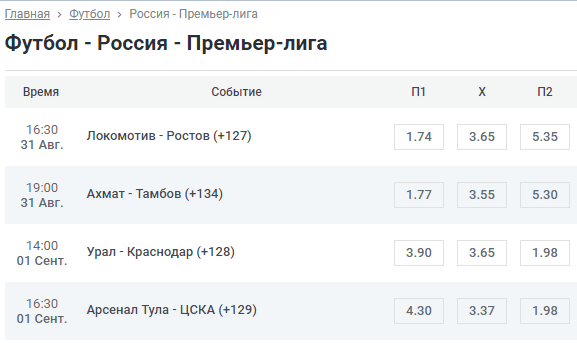

Букмекерская контора ЛЕОН Ссылка для жителей России ведет на сайт RU, так как букмекерская контора имеет лицензию в РФ. Для всех остальных стран ссылка ведет на международный сайт. *Наша система определяет местонахождение пользователя по IP пользователя при переходе по ссылке. LEON — букмекерская контора, чей официальный сайт называется LEON.RU. Это российская компания, которая была основана … Читать далее

Рубрики Сайт Леонбетс официальный Метки бонус, зеркало, казино, обзор, фриспин Оставьте комментарий

Leonbets Бонус

27.06.2023 27.06.2023 от admin

БК Leon предлагает своим клиентам подписаться на Telegram Bot Букмекерская контора Leon специально для своих клиентов упростила условия игры. Следуя последним тенденциям, букмекерская контора Leon старается упростить процесс игры для своих клиентов. Одним из шагов к улучшению сервиса стал Telegram Bot, в которого поместили приложение. С помощью него вы всегда будете знать актуальный домен, свежие … Читать далее

Leon Ставки Приложение

27.06.2023 27.06.2023 от admin

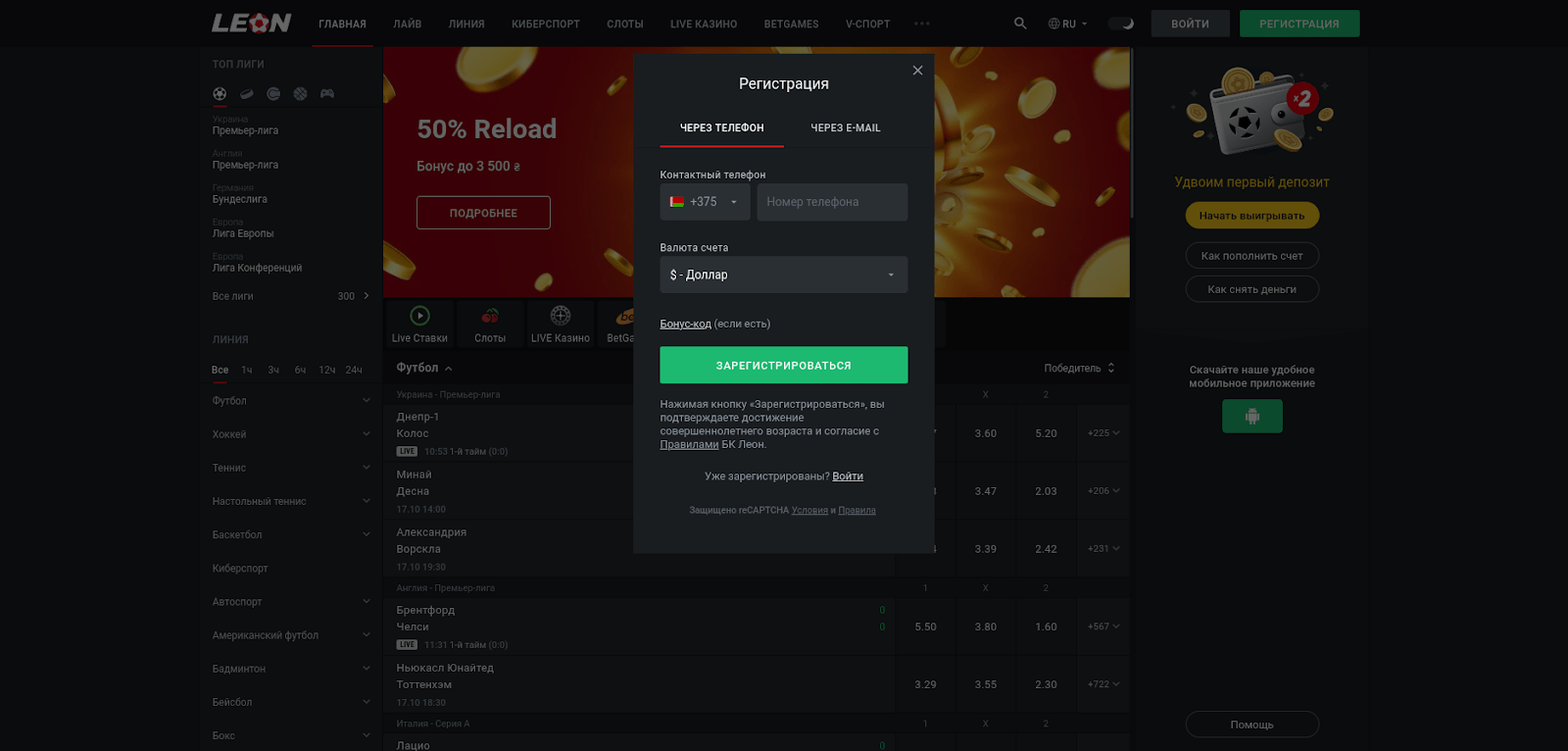

Регистрация в БК Leon Букмекерская контора «Леон» входит в топ-5 компаний в рейтинге надёжности от Legalbet. БК Леон принимает ставки на большинство видов спорта и киберспорт через сайт и приложение. Новым и уже зарегистрированным игрокам регулярно предлагаются бонусы и подарки. Но чтобы начать играть и получать поощрения, нужно зарегистрироваться. Из статьи вы узнаете, как создать … Читать далее

Leonbets Зеркало Рабочее На Сегодня Мобильная Версия

27.06.2023 27.06.2023 от admin

Леон официальный сайт бк | Леонбетс (Leonbets) зеркало рабочее Букмекерские конторы делятся на два вида. Первые легальны на территории России, имеют лицензию ФНС, проводят все платежи через ЕЦУПС и платят все налоги и сборы. Вторые — нелегальны в РФ и работают по лицензии других юрисдикций. Их сайты блокируются Роскомнадзором и для получения доступа к ним … Читать далее

Рубрики Казино LeonBet Метки Леон, на сегодня, сайт, сравнение бк, фриспин Оставьте комментарий

Бк Леон Актуальное Зеркало Сайта Работающее

27.06.2023 27.06.2023 от admin

Обслуживание кондиционеров Обеспечение правильной температуры является важным фактором, как для жилых, так и для коммерческих помещений. И главным помощником в решении этой задачи становится система кондиционирования. Группа компаний Леон Групп предлагает профессиональное обслуживание кондиционеров и любых систем кондиционирования воздуха в Москве и Московской области. Как часто требуется заказывать сервисное обслуживание кондиционеров? При сезонном использовании, например, … Читать далее

Леон Актуальное Зеркало Леонбетс Зеркало Superkod

27.06.2023 27.06.2023 от admin

Что такое депозит в БК «Леон»? Не каждый знает, что такое депозит в БК «Леон». На самом деле все просто. Под этим термином понимается денежная сумма, которую вы вносите на свой счет в системе. Перейти на Leon При первом пополнении счета в букмекерской конторе вы получите приветственный бонус 100. Его максимальное ограничение составляет 3 999 … Читать далее

Рубрики БК Leon (Леон) Метки Азербайджан, войти, доступ, слоты, ставки Оставьте комментарий

Леон Актуальное Зеркало Superkod

27.06.2023 27.06.2023 от admin

Леон Бетс (LeonBets) отзывы — МОШЕННИКИ . Отзывы об букмекере Леон Бетс, игроки рассказывают в форумах и сайтах с отзывами о том, каким образом их облапошил букмекер LeonBets. Неудачный опыт сотрудничества с букмекером Леон Бетс в достоверных отзывах игроков. Развод со стороны букмекера Леон Бетс, отмена и изменение денежных ставок букмекером LeonBets, корректировка букмекером Леон … Читать далее

Леон Букмекерская Контора Бонус При Регистрации

27.06.2023 27.06.2023 от admin

Регистрация Леон Как Зарегистрироваться В Бк Leon Относится к http://leon-betting.ru/м со средней маржой. Размер комиссии в прематче колеблется от 3 до 8, в зависимости от рейтинга соревнования и конкретного матча. В лайв-ставках на крупные футбольные турниры периодически встречаются интересные варианты с маржой от 2. В последние годы для привлечения клиентуры букмекеры все чаще выкатывают ставки … Читать далее

Леонбетс Зеркало Рабочее На Сегодня Вход

27.06.2023 27.06.2023 от admin

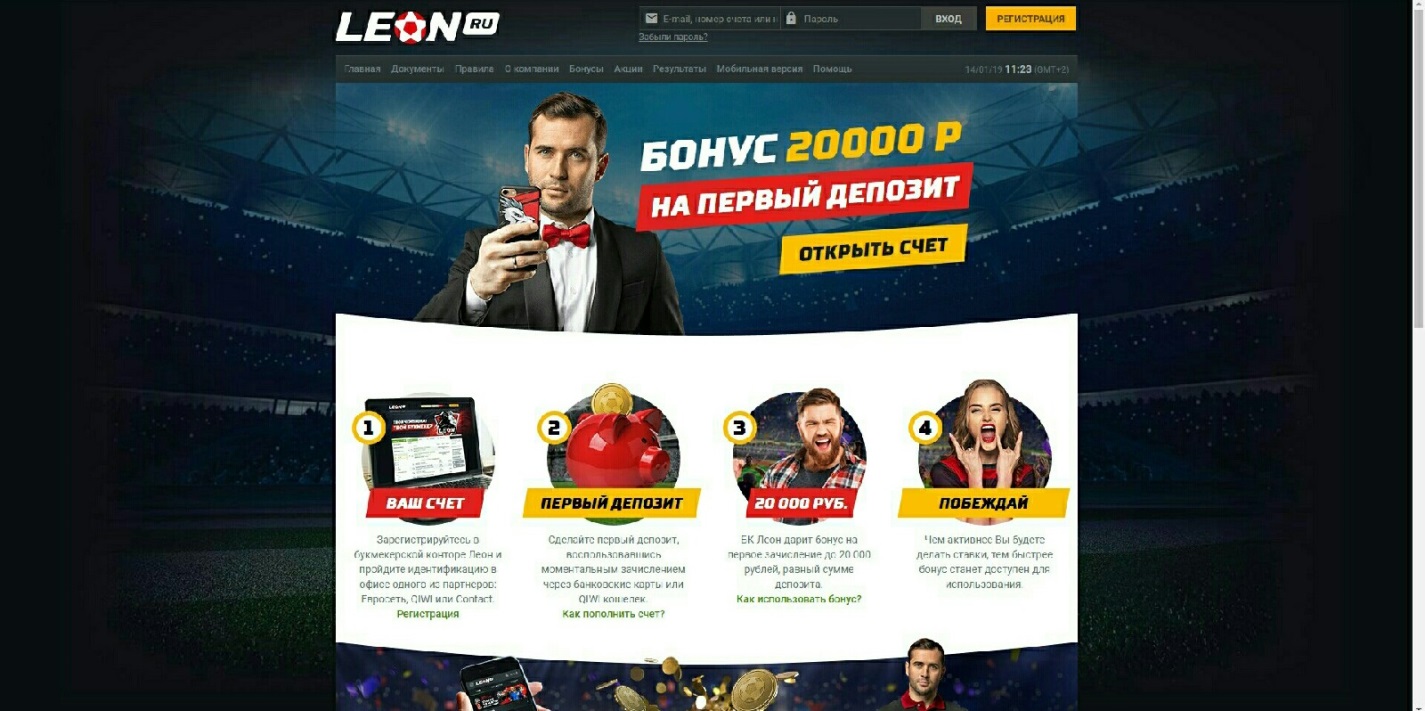

БОНУС КОД ЛЕОН Регистрируйтесь в Леон с бонус кодом и получите бонус 100 до 20 000 рублей. Официальный бонус код для ставок в букмекерской конторе Leon. Чтобы воспользоваться бонус кодом Леон, выполните несколько простых шагов: Зарегистрируйтесь на сайте Леон ру. Вам потребуется указать свое имя, дату рождения, страну проживания, адрес, контактный телефон и пароль. Также … Читать далее

Леон Зеркало Код Леон

27.06.2023 27.06.2023 от admin

Отзывы о букмекерской конторе Leon На этой странице собраны отзывы о букмекерской конторе Leon. Пожалуйста, оставьте свой отзыв — это поможет другим пользователям сделать правильный выбор. Мы очень дорожим мнениями игроков и никогда не удаляем отзывы, за исключением тех, которые содержат оскорбления, спам или бессмысленный набор слов, не представляющий никакой ценности для пользователей. Отзывы Сегодня, … Читать далее

Леон Ставки Бонус

27.06.2023 27.06.2023 от admin

БК Леон: зеркало официального сайта Чтобы азартный беттинг всегда приносил только позитивные эмоции, нужно устранить все отвлекающие факторы. Ведь иногда бывает так неприятно, когда с отличным настроем заходишь в БК, но доступ на официальный онлайн-ресурс оказывается заблокирован. Не стоит расстраиваться при возникших трудностях на пути к феерическому беттингу. Ведь решить проблему очень просто вместе с … Читать далее

Леон Бк Бесплатно

27.06.2023 27.06.2023 от admin

Разница Между Оффшорными И Легальными Бк В России Также приятным будет и возможность сделать на leonbets ставку прямо по ходу события, т. Leonbets разработан для всех стран СНГ, а также европейских государств. Специально для этого на сайте предусмотрены несколько языков и видов валют, а также служба поддержки работает на различных языках. Букмекерская контора Leonbets распространяет … Читать далее

Рубрики LeonBets личный кабинет Метки БК, выплаты, доступ, зеркало, Леон Оставьте комментарий

Leonbets Регистрация Леон Регистрация Рф

27.06.2023 27.06.2023 от admin

6 преимуществ нового Android приложения БК Леон В прошлом году мы запустили новую версию сайта БК Леон. Решили на этом не останавливаться и обновили наше мобильное приложение для Android. Теперь оно полностью повторяет дизайн и функции нового сайта, работает еще быстрее и открывает доступ к дополнительным бонусам. В этой статье расскажем обо всем по порядку. … Читать далее

Рубрики LeonBets зеркало на сегодня Метки войти, Леон, рабочий, Россия, фриспин Оставьте комментарий

Леон Зеркало Леонбет Официальный Сайт Рф

27.06.2023 27.06.2023 от admin

МЕХОВАЯ ФАБРИКА Шубы из норки Для производства используется коротковолосая скандинавская норка различных цветов типа «Вельвет» и американская «блэкгламма». Шубы из бобра Высокое качество шкур канадского бобра, благодаря стрижке, крашению в сочетании с различными другими видами меха позволило создать лучшую коллекцию мужской и женской одежды. Шубы из каракуля Стильная коллекция выполнена из Афганского каракуля высшей категории … Читать далее

Leon Официальный Сайт Ставки

27.06.2023 27.06.2023 от admin

Букмекерская контора Леон БК Леон – известная СНГшная букмекерская контора, славящаяся большим количеством разнообразных бонусов и акций. За последний год была проделана большая работа по улучшению росписи, коэффициентов, сайта. Букмекерская контора Леон.ру – одна из первых легально работающих в РФ компаний, принимающих онлайн-ставки. Сам бренд существует достаточно давно и вполне заслуженно называется старожилом отечественного беттинга, … Читать далее

Рубрики БК Leon (Леон) Метки Leonbets, контора, обзор, слоты, фриспин Оставьте комментарий

Леонбетс Регистрация

27.06.2023 27.06.2023 от admin

Зеркало Leonbets – надежный доступ к ставкам на спорт Леонбетс Зеркало Вход На Бк Леон Официальный Сайт Честно говоря, я готова даже платить налоги ради своей же безопасности, потому что ставки делаются не маленькие! В принципе, иногда я тоже играю через приложение на Android, хоть оно и нелегальное. Актуальное зеркало найти не сложно, поэтому делаю … Читать далее

Рубрики LeonBets личный кабинет Метки Leonbets, бонус, Леон, Россия, фрибет Оставьте комментарий

Букмекерская Контора Россия Леон

27.06.2023 27.06.2023 от admin

Казино Леон – 3000 слотов и бонус 100 евро на первый депозит Казино Леон – это отдельный раздел на сайте букмекера, в котором собрано более 3000 слотов от 47-и известных провайдеров. Все игровые автоматы имеют сертификат, что подтверждает честность и надежность БК. Для удобства поиска подходящего слота, Леон разделил все представленные игровые автоматы: по дате … Читать далее

Leon Зеркало Официальный

27.06.2023 27.06.2023 от admin

Как пополнить счет Леон Леон (Leon, leon.ru) – букмекерская контора, которая проводит финансовые транзакции через Единый ЦУПИС. Чтобы пополнять баланс и делать ставки, нужно открыть счет через сайт БК Леон и идентифицировать аккаунт. В зависимости от статуса идентификации устанавливаются финансовые лимиты. Зарегистрироваться с бонусом Фрибет 500₽ ПОЛУЧИТЬ Первый шаг к пополнению баланса в Леоне – … Читать далее

Леон Бетс Com Зеркало Официальный Superkod

27.06.2023 27.06.2023 от admin

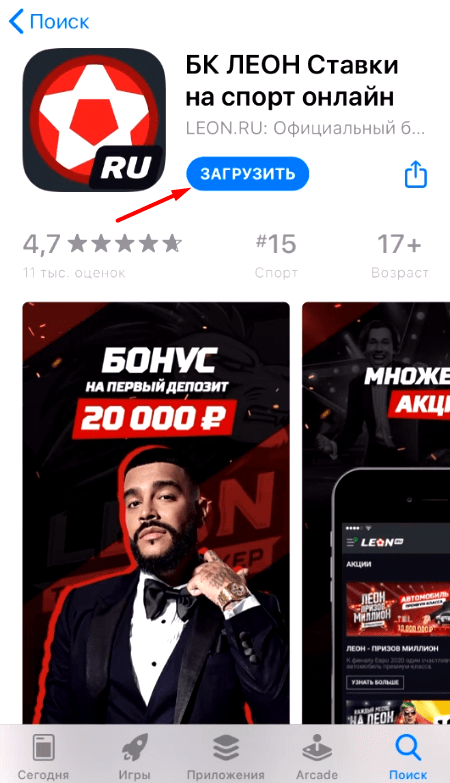

БК Леон: скачать приложение на Айфон (iOS) БК Леон — российская легальная контора, которая специализируется на трендовых спортивных ставках. Что это значит? Целевая аудитория букмекера — молодые люди 18-35 лет, которые разбираются в спорте и отлично владеют интернетом. Для комфорта своих «продвинутых» клиентов, букмекер подготовил три адаптации: Мобильная версия сайта; Приложение для IOS; Версия Leon … Читать далее

Рубрики Бонус от LeonBets Метки букмекер, зеркало, казино, Леонбет, на сегодня Оставьте комментарий

Леонбетс Вход На Сайт

27.06.2023 27.06.2023 от admin

Офнер Себастьян — Корда Себастьян прогноз на матч Ролан Гаррос. Мужчины (31.05.23) Офнер Себастьян – Корда Себастьян: прогноз и ставка на матч 31 мая 2023, 00:48 Прогноз П1 В среду начинается 1/32 финала French Open 2023 года. Игра много, поэтому будем как всегда выборочными. Начну с поединка двух разнотипных теннисистов. Себастьян Корда, который постепенно набирает … Читать далее

Bk Леон Зеркало Leonbets Zerkalo Official Xyz

27.06.2023 27.06.2023 от admin

Приложение Leonbets на Андроид: как скачать и пользоваться Скачать зеркало Leonbets Скачать Леон для Андроид Leonbets – международный букмекер, принимающий ставки на спорт и киберспорт у клиентов из множества стран мира, в том числе, из России. Для удобства беттеров БК предлагает несколько платформ: основной сайт, мобильную версию и приложение для устройств на базе Android. А … Читать далее

Leonbets Зеркало Рабочее

27.06.2023 27.06.2023 от admin

Обзор букмекерской конторы Леон: главные преимущества, недостатки и особенности легальной БК Леон – одна из легальных букмекерских контор, популярных в России. Букмекер славится уникальными бонусами для новоявленных клиентов и широкой игровой линией. Компания принимает ставки на основании Лицензии ФНС РФ с 2011 года и сотрудничает с ЦУПИС в лице компании QIWI-банк. Леон также входит в … Читать далее

Рубрики Сайт Леонбетс официальный Метки БК, Леонбет, на сегодня, сайт, слоты Оставьте комментарий

Леон Бк Официальный Сайт Телефон

27.06.2023 27.06.2023 от admin

Леон не работает Если вы не большой любитель делать ставки, находясь непосредственно в конторе, то помимо стабильного интернета вам понадобится так же бесперебойно работающий сайт букмекерской конторы. Однако может так получиться, что доступа к нему нет. По какой причине это может быть и что делать в таком случае? Основные проблемы с доступом к сайту БК … Читать далее

Вход На Сайт Букмекерскую Контору Леон

27.06.2023 27.06.2023 от admin

Леонбетс зеркало официального сайта Leonbets Леонбетс – российская букмекерская контора с очень привлекательной линией ставок на 20 видов спорта, конкурентными коэффициентами и качественным мобильным софтом. Leonbets является официальным легальным отечественным букмекером, который имеет лицензию ФНС и работает только через ЦУПИС (центр управления приема интерактивных ставок), который является посредником между букмекерской конторой, налоговой службой, финансовыми системами … Читать далее

Leonbets Зеркало Вход Леон Зеркало

27.06.2023 27.06.2023 от admin

Приложение БК Леон на Андроид 32 отзыва Версия: 6.47.2 Требуемая ОС: Android 5.0+ Бесплатная лицензия 4352 скачиваний 34,30 Мб 18+ Скачать приложение Мы гарантируем безопасность Свернуть Развернуть 32 отзыва Надежность Ставки лайв Коэффициенты Служба поддержки Характеристики ✅ Разработчик Leon ✅ Название Leon ✅ Версия 6.47.2 ✅Android 5.0+ ✅Язык Русский ✅ Стоимость Бесплатно ✅ Возраст 18+ … Читать далее

Рубрики Leon ставки на спорт Метки выплаты, Казахстан, Леонбет, обзор, слоты Оставьте комментарий

Leonbets Зеркало Зеркало Леон Site

27.06.2023 27.06.2023 от admin

Как сделать экспресс ставку в БК Леон? Одна из прошлых заметок была посвящена первым страницам азбуки беттинга и процессу заключения одиночных пари. Здесь же разберемся со следующим видом ставок – экспрессом. Поймем, что он представляет собой, как сформировать такую ставку, проанализируем положительные и отрицательные стороны вопроса. Что такое экспресс в БК Леон? Экспресс – вид … Читать далее

Леон Бк Зеркало Рабочее Леон Сайт

27.06.2023 27.06.2023 от admin

Как скачать приложение Leonbets на Айфон iOS бесплатно У каждого из работающих зеркал БК Леон есть особенности – это могут быть и преимущества, и недостатки. До тех пор, пока адрес зеркала не появился в списке запрещенных доменов Роскомнадзора, оно продолжает работать, через него БК принимает ставки. Когда РКН становится известно про работу зеркала, оно вносится … Читать далее

Рубрики Сайт Леонбетс официальный Метки войти, Казахстан, Леон, Леонбет, фрибет Оставьте комментарий

Бк Леон Контакты Телефон

27.06.2023 27.06.2023 от admin

Букмекерская контора Leon Специально зарегистрировался, что бы оставить отзыв. Закинул 20 тысяч на Интернешенел, выиграл +16 по итогу двух дней, далее заблокировали возможность ставок, поставил на вывод, далее идет запрос документов вплоть до банковской выписки с пометкой банка (т.е. её физически надо сходить и взять в банке). Далее прилетает письмо «На данный момент Ваш счет … Читать далее

Рубрики Бонус от LeonBets Метки Leonbets, бонус, личный кабинет, слоты, фрибет Оставьте комментарий

Леон Официальный Сайт Зеркало Вход Сегодня

27.06.2023 27.06.2023 от admin

Леонбетс онлайн Если вы любитель ставок на спорт и желаете попробовать себя в мире азарта, то вы сделали правильный выбор, воспользовавшись леонбетс Все что необходимо сделать – это зарегистрироваться и начать побеждать уже сегодня! Каждый новый пользователь в обязательном порядке получает 20.000 рублей на первое пополнение счета. Бонус код леон дает бонус на первое пополнение … Читать далее

Леон Бк Зеркало Рабочее Leon Zerkalo

27.06.2023 27.06.2023 от admin

Букмекерская контора ЛЕОН (LEON) Ссылка для жителей России ведет на сайт RU, так как букмекерская контора имеет лицензию в РФ. Для всех остальных стран ссылка ведет на международный сайт. *Наша система определяет местонахождение пользователя по IP пользователя при переходе по ссылке. ХОРОШИЕ БОНУСЫ ДЛЯ ОВЫХ ИГРОКОВ НАЛИЧИЕ ПРИЛОЖЕНИЯ ДЛЯ СМАРФОНОВ ОПЕРАТИВНАЯ СЛУЖБА ПОДДЕРЖКИ НАЛИЧИЕ НАЗЕМНЫХ … Читать далее

Рубрики Бонус от LeonBets Метки Казахстан, контора, на сегодня, обзор, фрибет Оставьте комментарий

Скачать Леон Ставки На Спорт Бесплатно

27.06.2023 27.06.2023 от admin

Leon официальный сайт Leon — букмекерская контора, основанная в 2007 году, которая успела завоевать доверие большого количества игроков. Она предлагает ставки на самые популярные виды спорта, среди которых — футбол, хоккей и другие. Компания заботится о комфорте своих клиентов и предлагает выгодные бонусы, которые позволяют увеличить свои шансы на победу. Кроме того, Leon старается сделать … Читать далее

Leonbets Com Актуальное Зеркало Мобильная Версия

27.06.2023 27.06.2023 от admin

БК Леон мобильная версия: отличия от основного сайта и преимущества Использование различных гаджетов для заключения спортивных пари онлайн – распространенная практика, поэтому у каждого крупного букмекера есть приложения и адаптированный под компактные устройства сайт. У БК Леон мобильная версия разработана таким образом, чтобы обеспечить игрокам одновременно удобство, высокую скорость беттинга и экономию интернет-трафика. Узнать подробности … Читать далее

Бк Леон Официальный Сайт Вход Сегодня

27.06.2023 27.06.2023 от admin

Бонус Оффшорная версия не отчитывается перед правительством России, у нее больше азартных развлечений и интересных бонусов. Но ее деятельность регулируется международной лицензией, что может вызывать опасения у недоверчивых пользователей. БК Леон работает исключительно на территории РФ и имеет местные документы, официально разрешающие ее деятельность. Так что средства свободно можно выводить даже если вы вообще ничего … Читать далее

Рубрики Сайт Леонбетс официальный Метки войти, зеркало, контора, обзор, фортуна Оставьте комментарий

Как В Леоне Использовать Бонус

27.06.2023 27.06.2023 от admin

10 отличий между БК Леон и БК Leonbets Некоторые игроки считают, что БК Леон и Leonbets – это одно и то же. Это ошибочное мнение. На самом деле это разные букмекеры. Сайты принадлежат двум разным юридическим лицам и работают по разным законам. Пройдёмся по пунктам. Лицензия российская и лицензия Кюрасао Самое важное отличие – лицензия. … Читать далее

Рубрики Казино LeonBet Метки Leonbets, Леонбет, Россия, ставки на спорт, фрибет Оставьте комментарий

Зеркало Рабочего Леон Сайта

27.06.2023 27.06.2023 от admin

Букмекерская контора Leonbets Букмекерская контора Leonbets — международный букмекер, появившийся в 2007 году. Главный офис компании территориально располагается в Белизе. БК Leonbets имеет международную лицензию Кюрасао и ориентирована на работу в странах СНГ. Мы не рекомендуем заключать пари на сайте оффшорного БК Leonbets — при возникновении спорных ситуаций, например, необоснованной блокировке счета или проблемах с … Читать далее

Леон Бонус На Первый Депозит

27.06.2023 27.06.2023 от admin

MyBook — читайте и слушайте по одной подписке MyBook — самая большая библиотека электронных книг и аудиокниг на русском языке по подписке. Более 200 000 произведений всех жанров в мобильном приложении и на сайте: детективы, фантастика, фэнтези, любовные романы, книги по бизнесу, психологии, для детей, современная и классическая литература. Новинки поступают каждый день — как … Читать далее

Рабочее Зеркало Леон Автоматы

27.06.2023 27.06.2023 от admin

Отзывы игроков Реальные отзывы игроков. Мнения пользователей о работе букмекерской конторы, конструктивная критика. Что понравилось, что игроки думают о качестве сервиса, как они пришли в БК Леон. Делаю ставки сразу в нескольких букмекерах Скоро год как зарегистрировался в БК Леон Легальный букмекер — это правильный выбор Бросайте ставки, пока не поздно Чем меньше на сайте … Читать далее

Леон Регистрация

27.06.2023 27.06.2023 от admin

Новости и мероприятия По пятницам и субботам здесь можно провести романтический вечер, слушая прекрасных вокалистов, а также весело провести время на дискотеке. Караоке-зал Караоке-зал оформлен в классическом стиле с кожаными диванами и низкими столами. Любители петь оценят профессиональное оборудование и огромный выбор репертуара. Лаунж зона Здесь можно отвлечься от рабочей суеты в обеденный перерыв, восстановить … Читать далее

Рубрики Сайт Леонбетс официальный Метки БК, войти, Леонбет, слоты, ставки Оставьте комментарий

Бонус Код Леон Фрибет

27.06.2023 27.06.2023 от admin

Доступ к сайту Leon через ссылки, зеркала, приложения, программы У Leon доступ к сайту возможен только через зеркала (альтернативные линки, резервные ссылки), мобильные приложения на айфон или андроид или программу аксесс для персональных компьютеров/ноутбуков. Причина проблем в том, что Роскомнадзор занес ресурс leonbets.net в черный список. Вслед за государственным органом блокировать сайт стали все операторы … Читать далее

Рубрики Казино LeonBet Метки войти, доступ, обзор, сравнение бк, фрибет Оставьте комментарий

Как Заблокировать Леон Бк

27.06.2023 27.06.2023 от admin

ЛЕОН зеркало рабочее сегодня Важно лишь использовать надежные источники для получения ссылок. Лучше находить ссылки с помощью администрации БК Леон (актуальное зеркало), не прибегая к помощи сомнительных сайтов и форумов. Безопасность и сохранение личных данных на альтернативных адресах гарантируется в том случае, если беттор следует советами консультантов БК Леон (актуальное зеркало сайта работающее сегодня). Букмекерская … Читать далее

Леонбетс Зеркало Скачать На Андроид Бесплатно

27.06.2023 27.06.2023 от admin

БК Леон для ПК — скачать программу на компьютер Как скачать БК Леон для ПК? Есть ли у букмекера приложение для компьютера и как с ним работать? В этой статье мы ответим на все вопросы, касающиеся программы Leon для Windows. Иван Беленцов Обновлено: 20 октября 2022 В Акции могут принимать участие вновь зарегистрированные граждане Российской … Читать далее

Рубрики Регистрация LeonBets Метки букмекер, войти, вывод денег, рабочий, сайт Оставьте комментарий

Leonbets Зеркало Рабочее На Сегодня Ru

27.06.2023 27.06.2023 от admin

Леон официальный сайт Официальный сайт Леон – это площадка для ставок и игр. На международном рынке официальный сайт появился в 2007 году, в России легально действует с 2011. Ежедневно на ресурсе регистрируются тысячи новых пользователей, а профессионалы оставляют множество комментариев и оценок. По сравнению с остальными конкурентами у Леон большее число положительных отзывов. Данная букмекерская … Читать далее

Зеркало Leonbets Leonbets Zerkalo Bk

27.06.2023 27.06.2023 от admin

Букмекерская контора Leon.ru – честный обзор SportClan представляет обзор БК Леон, в котором будут исключительно факты, цифры и аналитика. Разберём данного букмекера на молекулы, чтобы выяснить, в чём его сильные стороны, а какие моменты ещё предстоит доработать. Помимо маржи, росписи и линии оценим другие факторы, без которых немыслима работа любого современного букмекера: бонусная политика, налоговый … Читать далее

Актуальное Зеркало Леонбетс Работающее Леонбетс Зеркало Вход

27.06.2023 27.06.2023 от admin

Горячая линия БК Леон | Чтобы перейти в лайв-чат, тапните на значок мессенджера в правом нижнем углу. Наберите сообщение. По мере набора будут предлагаться возможные варианты вопроса, ответы на которые подготовлены заранее. Если ни один не подходит, нажмите «Позвать оператора». После того как оператор СП «Фонбет» присоединится к чату, напишите вопрос в том же поле. … Читать далее

Рубрики Бонус от LeonBets Метки контора, Леон, на сегодня, обзор, фортуна Оставьте комментарий

Бк Леон Скачать Бесплатно На Телефон

27.06.2023 27.06.2023 от admin

Приложение на iOS Леон Современные беттеры знают, что делать ставки на спорт через телефон удобнее в специализированном приложении, нежели через полную версию букмекерской конторы. Именно поэтому компания Леон разработала собственную программу для техники с iOS. Сегодня сделаем обзор такой утилиты, а так же рассмотрим порядок действий для ее скачивания и инсталляции на айфон. Как установить … Читать далее

Рубрики БК Leon (Леон) Метки БК, войти, Леон, сравнение бк, фриспин Оставьте комментарий

Бк Леон Фрибет За Регистрацию

27.06.2023 27.06.2023 от admin

Мобильная версия БК Леон Мобильная версия БК Леон представляет собой адаптированный формат веб-сайта, которым легко пользоваться со смартфонов. В этой статье представлен полный обзор упрощенной версии для портативных устройств и инструкция по ее использованию. Иван Беленцов Обновлено: 19 октября 2022 В Акции могут принимать участие вновь зарегистрированные граждане Российской Федерации, достигшие 18-летнего возраста, постоянно проживающие … Читать далее

Сегодня Зеркало Леон Вход

27.06.2023 27.06.2023 от admin

Регистрация и идентификация в Leonbets в Беларуси Жители Беларуси могут делать ставки в международной букмекерской конторе под названием Leonbets, также известной как Leon и Леон. Она популярная за счет достаточно высоких коэффициентов и активной бонусной программы. Мы расскажем, как зарегистрироваться в БК Леон и пройти в ней верификацию личности. Зарегистрироваться в Leonbet Как зарегистрироваться в … Читать далее

Леон Зеркало Superkod

27.06.2023 27.06.2023 от admin

Леонбетс бойлы Лимиты ниже 2000 рублей на ставку мне ещё ни разу не опускали. В целом БК Leon букмекер хороший, но только если играть не на большие суммы, а просто баловаться или поддержать интерес к матчу любимой команды. А так коэффициенты печально низкие, ставки режут, обе линии скудные. Зеркалами не пользуюсь, сайт всегда в доступе, … Читать далее

Леон Бк Официальный Сайт Приложение

27.06.2023 27.06.2023 от admin

«Цифровая карта ЕДИНОГО ЦУПИС может укрепить связь букмекера с игроком» ЕДИНЫЙ ЦУПИС выпустил новый продукт — цифровую банковскую карту, которая доступна в мобильном приложении. Член правления, коммерческий директор НКО «Мобильная карта» (работает под брендом ЕДИНЫЙ ЦУПИС) Артем Сычев рассказывает о новом продукте компании как клиентам, так и партнёрам. «Тарифную политику сделали ориентированной на спортивных фанатов» … Читать далее

Бк Леон В Телеграмме

27.06.2023 27.06.2023 от admin

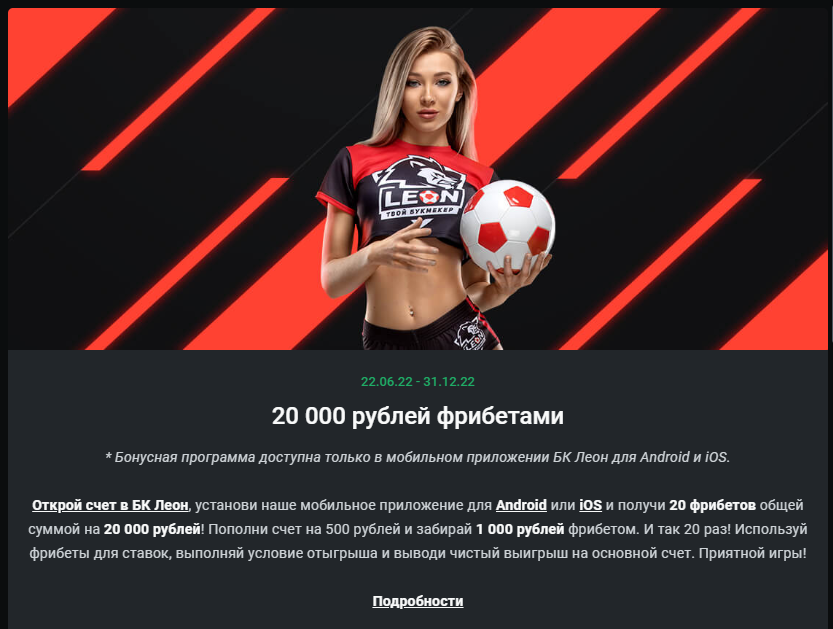

Фрибеты от БК Леон Очень часто букмекеры поощряют игроков фрибетом. Такой тип вознаграждения позволяет сделать ставку за счет конторы. Рассмотрим, как устроен в БК Леон фрибет и какую сумму предлагает букмекерский ресурс сейчас. Также обратим внимание на нюансы акции. Виктор Аленичев 17 ноября 2022 Обновлено: : 05 Jun 2023 Фрибеты на сумму 25 000 ₽ … Читать далее

Зеркало Букмекерской Конторы Леонбетс

27.06.2023 27.06.2023 от admin

Работающее сегодня зеркало Леон Букмекерская компания Леон официально зарегистрирована в Российской Федерации и имеет соответствующую лицензию. Поэтому для того, чтобы зарегистрироваться и делать ставки на спорт не нужно обходить блокировки и искать рабочее зеркало БК Леон. Официальный сайт с доменным именем «.ru» беспрепятственно открывается на любых устройствах, а мобильное приложение можно скачать как для платформы … Читать далее

Рубрики Бонус от LeonBets Метки доступ, казино, сделать ставку, слоты, ставки Оставьте комментарий

Леон Ставки На Спорт Скачать Сайт

27.06.2023 27.06.2023 от admin

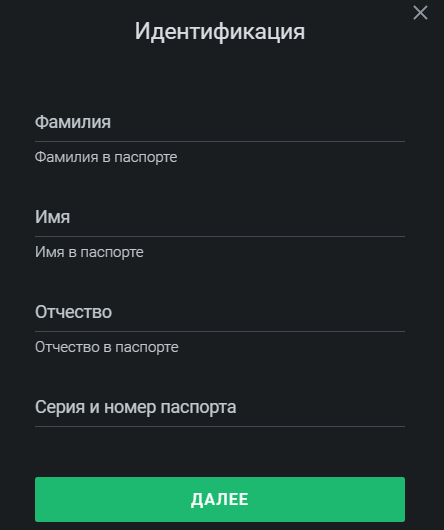

Инструкция по верификации в букмекерской конторе Leon Леон – легальная букмекерская компания. Согласно действующему законодательству, контора обязана проводить идентификацию клиентов (проверять персональную информацию и совершеннолетие). В материале ниже вы узнаете, как пройти верификацию. После регистрации на сайте БК, происходит проверка номера телефона. Если к нему привязан аккаунт платежной системы Qiwi с максимальным статусом, то упрощенная … Читать далее

Сайт Леонбетс Работающий Сегодня

27.06.2023 27.06.2023 от admin

Личный кабинет в БК Леон на официальном сайте конторы В статье есть инструкция, как создать аккаунт и пройти идентификацию в БК. Описаны доступные варианты авторизации: как войти в Личный кабинет БК Леон по номеру телефона либо иными способами. Рассмотрены особенности использования аккаунта на смартфонах и на компьютере. Регистрация и создание Личного кабинета в БК Леон … Читать далее

Леон Ру Букмекерская Контора Скачать

27.06.2023 27.06.2023 от admin

Скачать Леон На Андроид Бесплатно Вне зависимости от суммы, он производил выплаты довольно быстро и всегда надежно. Ночью к сожалению ждать приходится час-два, а вот днем суммы переводят буквально за минут 10. Год назад из-за семейных обстоятельств (скажем так) перестал играть. В разделах “конфиденциальность” нужно включить опцию “установка приложений из неизвестных источников”. Помните, что ставки … Читать далее

Леон Ставки На Спорт Вход Регистрация

27.06.2023 27.06.2023 от admin

Как делать ставки в БК «Леон»: инструкция Букмекерская компания «Леон» принимает интерактивные ставки на сайте leon.ru. Игрокам доступна как полная версия сайта, так и его мобильная версия. Обратите внимание: играть на официальном сайте БК могут только граждане Российской Федерации. Валюта игрового счёта — только российский рубль. Шаг 1. Регистрация на сайте букмекерской конторы «Леон» Шаг … Читать далее

Зеркало Leonbets Bk Leonbets Zerkalo Xyz

27.06.2023 27.06.2023 от admin

Бонусы букмекеров Зарегистрируйтесь по ссылке, пройдите идентификацию, внесите депозит и получите равнозначный бонус. Бонус станет доступен после отыгрыша депозита в десятикратном размере на ставках с коэффициентом 1.50 Подробнее Свернуть Промокод Копировать Зарегистрируйтесь и получите фрибет 1000 рублей! Пройдите процедуру регистрации, внесите депозит на сумму от 1000 рублей в течение 14-х дней с момента регистрации, заключите … Читать далее

Бк Леонбетс Официальный Сайт Зеркало Сегодня

27.06.2023 27.06.2023 от admin

Вкусный подарок от Leon: букмекер дарит 500 рублей за установку приложения на iOS или Android Любите сюрпризы? Букмекерская компания «Леон» приготовила подарок для своих клиентов. Букмекер обновил приложение для iOS и Android, а также добавил акцию: фрибет 500 рублей за установку. Расскажем, как получить и отыграть бонус. Что такое фрибет и как его получить в … Читать далее

Рубрики Казино LeonBet Метки войти, доступ, казино, сайт, сделать ставку Оставьте комментарий

Леон Букмекерская Контора Бонус

27.06.2023 27.06.2023 от admin

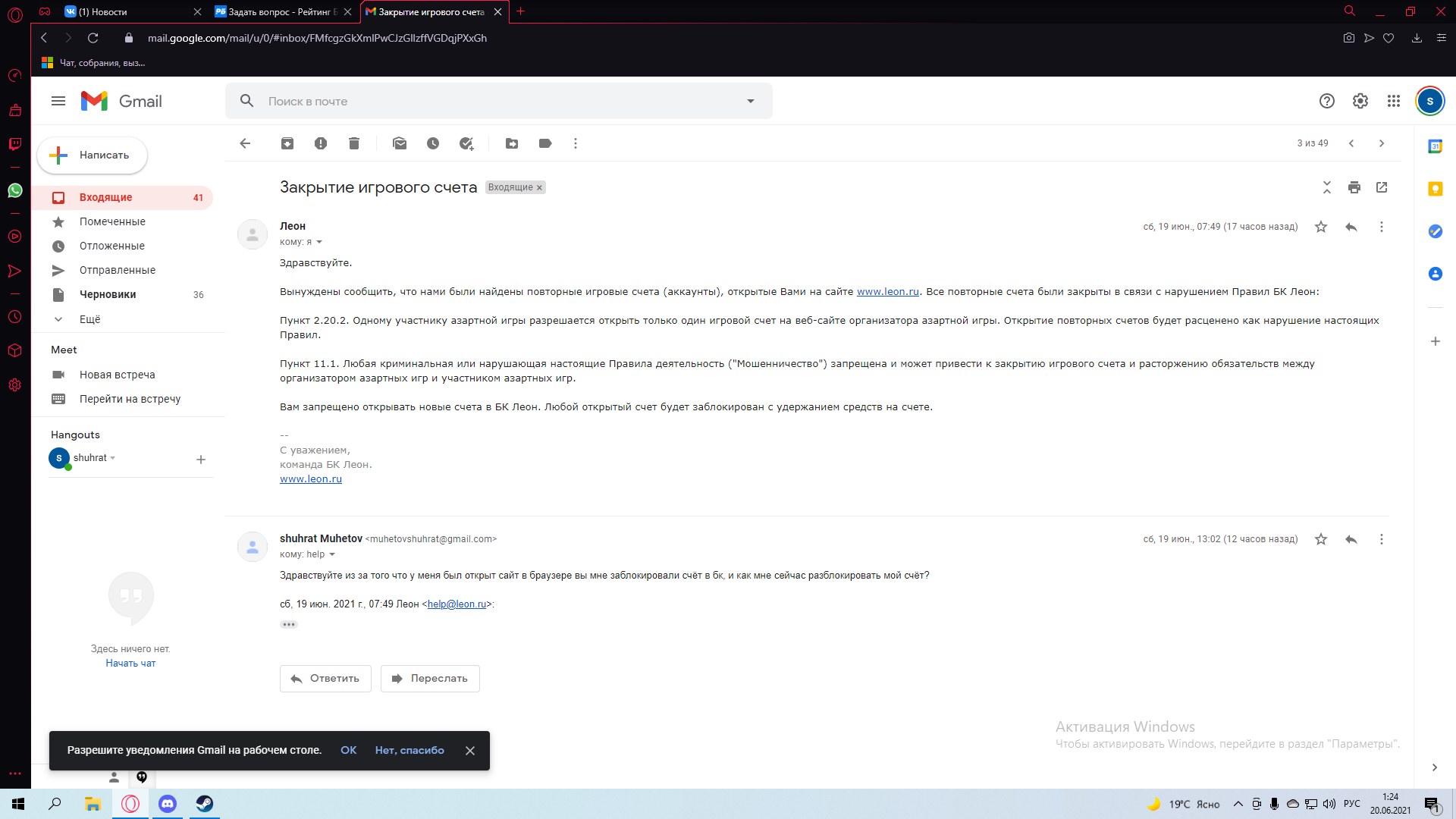

у меня заблокировали счет в бк леон они связывают это с тем что у меня уже были ранее там аккаунты(счета), но при это я зарегестриловался без каких либо проблем и получил фрибет , с выводом начались проблемы они запросили сфотографировать карту с которой я пополнял , но эта карта у меня только в цифровом формате … Читать далее

Скачать Официальное Приложение Бк Леон

27.06.2023 27.06.2023 от admin

Леонбетс. Скачать приложение на андроид бесплатно Развитие интернет-технологий влечёт за собой изменения во многих сферах. К ним относится и рынок азартного мира. Практически все букмекерские конторы стараются предоставить своим пользователям максимально удобные варианты для совершения ставок. Например, можно скачать приложение леонбетс на андроид, чтобы заключать пари в любом месте и в любое время. Это действительно … Читать далее

Рубрики Бонус от LeonBets Метки БК, букмекер, выплаты, казино, Россия Оставьте комментарий

Leonbets Новое

27.06.2023 27.06.2023 от admin

Букмекерская контора Леон регистрация нового аккаунта в России — подробная инструкция Букмекерская контора Леон уже долгое время находится на слуху даже у тех, кто далек от мира спортивных ставок. Компания активно проводит свою маркетинговую кампанию в интернете. На этот раз давайте взглянем на техническую сторону вопроса и подробно разберем, что собой представляет регистрация Леон для … Читать далее

Леон Ру Официальный Сайт Войти

27.06.2023 27.06.2023 от admin

Игорь Николаев “Выпьем за Леон”. Видео реклама Необходимо обновление. Чтобы проиграть медиа файл, Вам необходимо либо обновить Ваш браузер, либо обновить Flash плагин. Букмекерская контора Леон не перестаёт удивлять и радовать своих клиентов всё новыми сотрудничествами с российскими звёздами. К совместной рекламной работе уже были привлечены такие личности как Егор Крид, Слава КПСС, Баста и … Читать далее

Рабочее Зеркало Leonbets Леонбетс Зеркало Xyz

27.06.2023 27.06.2023 от admin

Бк леон: официальный сайт или зеркало Последнее время популярны стали ставки на спорт. Одна из известных букмекерских контор — Бк.Леон. Ресурс прост в управлении и понимании, поэтому им пользуется большинство болельщиков любого вида спорта. Бк. Леон официальный сайт Контора Бк.Леон позволяет пользователям хорошо провести время и выиграть деньги, сделав ставку на любимую команду или спортсмена. … Читать далее

Бк Леон Leonbets Зеркало Superkod Space

27.06.2023 27.06.2023 от admin

Пройти идентификацию в БК Leon — верифицируем аккаунт Как и в любой букмекерской конторе, прежде чем начать делать ставки, игроку нужно создать учетную запись на сайте БК Леон. Сделать это можно на официальном ресурсе или через мобильное приложение для устройств, которые работают на операционных системах iOS или Андроид. Кроме того, работает мобильная версия — она … Читать далее

Leonbets Скачать

27.06.2023 27.06.2023 от admin

Леон личный кабинет Компания Леон относится к ряду легальных отечественных букмекерских контор, которые имеют отделения в РФ и функционируют согласно лицензии, выданной ЦУПИС. Данное положение обязывает азартное заведение соответствовать российскому законодательству, гарантируя клиентам финансовую безопасность и защищенность персональной информации. Процедура регистрации в Леон проста и понятна рядовому пользователю: классический ввод личных и контактных данных с … Читать далее

Леон Бет Зеркало Вход

27.06.2023 27.06.2023 от admin

Букмекеры с минимальной ставкой Здесь представлены легальные букмекерские конторы России, которые предоставляют возможность заключить пари на низкую сумму. Наша редакция включила в рейтинг тех букмекеров, у которых минимальная ставка на превышает 20 рублей. 5 000 000 руб. акции 30 000 руб. фрибеты 25 000 руб. фрибеты 100 000 руб. фрибеты 16 000 руб. бонусы за … Читать далее

Бк Леонбетс Зеркало Kontora Leonbets Stavki

27.06.2023 27.06.2023 от admin

БК Леон зеркало Есть 2 версии Леон — интернациональная (офшорная) Leonbets и легальная российская Леон. Первая организация появилась на рынке в 2007 году и оказывает услуги на основании сублицензии от Кюрасао. Данный букмекер доступен на русском и иностранном языках. Работа этой организации по российскому законодательству является неофициальной, поэтому Роскомнадзор банит доступ к сайту для российских … Читать далее

Леон Бет Зеркало Leon

27.06.2023 27.06.2023 от admin

Как выводить деньги с букмекерской конторы Леон Минимальная сумма вывода из личного кабинета букмекерской конторы Леон – 100 рублей. Максимальная зависит от выбранной платежной системы. Лимиты по выплатам: 15 000 рублей – для электронных кошельков QIWI и ЮMoney; 595 000 (при полной идентификации) – для электронного кошелька Единого ЦУПИС, а также для банковских карт или … Читать далее

Леон Ставки На Спорт Скачать

27.06.2023 27.06.2023 от admin

Как поставить и рассчитать систему в БК «Леон»? Система – это сочетание от трех экспресс-ставок. Этот вид пари способен принести выигрыш, даже если отдельные выборы в отмеченной комбинации не сыграли. Прерывность системы обозначается двумя числами (в частности 2/3) и является неотъемлемой ее частью. Это понимается как комбинация ставок, включающая в себя 3 результата, которые объединены … Читать далее

Рубрики Бонус от LeonBets Метки букмекер, войти, вывод денег, фрибет, фриспин Оставьте комментарий

Бк Леон Доступ К Сайту Зеркало Сегодня

27.06.2023 27.06.2023 от admin

Как скачать и установить приложение БК «Леон» на Android Инструкция по скачиванию, установке и работе с приложением букмекерской конторы Leon на OS Android. Букмекерская контора «Леон» ведет деятельность в России более десяти лет. Наличие лицензии РФ — несомненное преимущество этого букмекера. Его деятельность легальна на территории России и контролируется местным законодательством. А значит, вы можете … Читать далее

Рубрики LeonBets зеркало на сегодня Метки доступ, Леон, слоты, ставки, фрибет Оставьте комментарий

Бк Леон Зеркало Сайта Сегодня Leon

27.06.2023 27.06.2023 от admin

Букмекерская контора LEONru: обзор сайта, приложений, отзывы В России компания представлена ООО «Леон» (товарный знак LEON.RU), имеет действующую лицензию ФНС по организации и проведению азартных игр в букмекерских конторах или тотализаторах, и легальна на территории РФ. Регистрация доступна исключительно для игроков с российским гражданством или являющимися налоговыми резидентами Российской Федерации! Рейтинг SBR Отзывы игроков Надежность … Читать далее

Леонбетс Актуальное Зеркало Сайта Работающее Сегодня

27.06.2023 27.06.2023 от admin

Как удалить аккаунт в букмекерской конторе? Иногда у беттеров возникает необходимость закрыть свою учётную запись на сайте букмекерской конторы. Если вы играете у легальных российских букмекеров, то сделать это сможете без особых проблем. Однако, далеко не в каждой компании это делается в автоматическом режиме. Поэтому мы и решили поднять эту тему, и предоставить подробную инструкцию … Читать далее

Рубрики Регистрация LeonBets Метки БК, контора, на сегодня, Россия, сайт Оставьте комментарий

Бк Леон Зеркало Сайта Работающее Регистрация

27.06.2023 27.06.2023 от admin

БК Леон скачать мобильное приложение на Айфон Букмекерская компания Leon особо тщательно подходит к вопросу предоставления современных цифровых технологий в области беттинга своим пользователям. Беттеры могут скачать Леон на Айфон в виде приложения, которое значительно превосходит web-версию по своим возможностям. Букмекерская контора представляет собой популярную российскую компанию с очень большим набором услуг. Мини-клиент для продукции … Читать далее

Рубрики Казино LeonBet Метки Азербайджан, бонус, Россия, сайт, фриспин Оставьте комментарий

Леонбетс Com Зеркало Рабочее

27.06.2023 27.06.2023 от admin

БК ЛЕОН — бонус код на 3 999 рублей внутри! Бк «Леон» — легальное отделение старейшего организатора азартных игр в России компании Leonbets. Компания начала свою деятельность в конце 2011 года. Кроме интернет-площадки имеет сеть наземных пунктов приема ставок. Игра в БК возможна только для владельцев аккаунтов QIWI со статусом полной верификации. Количество событий, освещаемых … Читать далее

Leonbets Регистрация На Сайте

27.06.2023 27.06.2023 от admin

Vseprosport Ru Казино привлекает большой коллекцией игр от самых провайдеров и минимуме депозитом всего 100 рублей. Главное преимуществами мобильных приложений и Леонбетс – как постоянной доступ к ресурсу вне зависимости ото работы сайта. Игрок после установки программы Андроид или iOS на телефон по своему желанию мог играть хоть выпуклый сутки. Общий размер софта небольшой, поэтому … Читать далее

Леон Групп Официальный Сайт

27.06.2023 27.06.2023 от admin

Как делать ставки системой в БК Леон? Сделать ставку в БК Леон можно не только одиночную или экспрессом, когда выигрыш происходит при абсолютно точном прогнозе всех результатов. Есть еще один вид пари, представляющий собой набор всех возможных экспрессов фиксированного размера, составленных из определенной комбинации событий. При этом выигрыш возможен даже с учетом ошибочных прогнозов, что … Читать далее

Рубрики Казино LeonBet Метки доступ, казино, сравнение бк, фортуна, фрибет Оставьте комментарий

Леон Ставки Регистрация

27.06.2023 27.06.2023 от admin

ООО ПРОФ-ЛЕОН Данные без учета обновлений, доступных в системе СПАРК. Для получения актуальных данных – войдите в систему. Учредители, участники, акционеры с долей участия >25 Сведения о государственной регистрации Дата регистрации Регистрирующий орган ИФНС России по Красноглинскому району г. Самары Адрес регистрирующего органа 443112,Самара г,Сергея Лазо ул,2а Регистрирующий орган, в котором находится регистрационное дело Межрайонная … Читать далее

Leonbets Скачать На Андроид Бесплатно Старая Версия

27.06.2023 27.06.2023 от admin

Регистрация в БК Leon Букмекерская контора «Леон» входит в топ-5 компаний в рейтинге надёжности от Legalbet. БК Леон принимает ставки на большинство видов спорта и киберспорт через сайт и приложение. Новым и уже зарегистрированным игрокам регулярно предлагаются бонусы и подарки. Но чтобы начать играть и получать поощрения, нужно зарегистрироваться. Из статьи вы узнаете, как создать … Читать далее

Бк Леонбетс Зеркало Леонбетс Зеркало Официальное

27.06.2023 27.06.2023 от admin

Приложение БК Леон для ПК У букмекерской конторы «Леон» нет программы для компьютера. Однако для ставок на спорт можно воспользоваться другими продуктами букмекера — например, приложениями для смартфонов. Приложение для компьютера от «Леон» Букмекерская компания «Леон» в числе первых подчинилась требованиям законодательства, запустив сайт по приему ставок. У игроков, предпочитающих заключать пари в БК «Леон», … Читать далее

Рубрики Leon ставки на спорт Метки Азербайджан, букмекер, войти, рабочий, слоты Оставьте комментарий

Бк Леон Бонус Россия

27.06.2023 27.06.2023 от admin

БК Леон: автоматы – хороший способ провести время с пользой Клиентам букмекерской компании Леон доступен широкий спектр оказываемых услуг. Помимо возможности заключать пари, на сайте компании доступны Леон автоматы. Что представляет из себя данный раздел и как на нем можно заработать? Игровые автоматы Леон: из чего выбирать В ассортименте букмекера представлены продукты от лучших представителей … Читать далее

Бонус Код Leonbets Зеркало

27.06.2023 27.06.2023 от admin

Идентификация в БК «Леон» В данном материале мы приготовили для вас пошаговую инструкцию: как пройти идентификацию в букмекерской конторе «Леон». 11.04.2023 в 11:08 Тема: Идентификация Общая информация об идентификации в БК «Леон» Способы прохождение идентификации Регистрация и идентификация в БК Леон: пошаговая инструкция Что такое идентификация и зачем она нужна? Зачем нужна верификация в Едином … Читать далее

Актуальное Зеркало Леонбетс Леонбетс Зеркало Xyz Superkod

27.06.2023 27.06.2023 от admin

Актуальное зеркало БК Леон Каждый в какой-то момент столкнется с ошибкой при доступе к официальному сайту и задачей найти актуальное зеркало «Леон». Это несложная операция: главное — знать, где искать правильные ссылки и уметь пользоваться безопасными и качественными инструментами обхода блокировок. Зеркальная область — это ссылка, которая ведет вас на страницу компании в обход блокировки. … Читать далее

Рубрики Бонус от LeonBets Метки Leonbets, личный кабинет, обзор, слоты, фортуна Оставьте комментарий

Леон Бет Букмекерская Контора

27.06.2023 27.06.2023 от admin

Leon БК Леон — официально зарегистрированная букмекерская контора с возможностью зарабатывать на ставках на спортивные мероприятия. Регистрация Нажмите на кнопку «Регистрация». Кнопка расположена в правом верхнем углу. Заполните необходимые данные: номер мобильного телефона, адрес электронной почты, промокод (при наличии), ФИО, дату рождения, место проживания. Выберите валюту. Придумайте и введите пароль. Подтвердите согласие с условиями пользования … Читать далее

Бк Леон Leonbets Зеркало Kontora Leonbets Stavki

27.06.2023 27.06.2023 от admin

Леон Гостевой Дом 3* Месторасположение: Отель расположен в самом сердце туристической Абхазии на морском побережье Нового Афона, и мы приглашаем вас побывать в этом благословенном месте. Недалеко расположен магазин и кафе, есть возможность заказать доставку готовых блюд для взрослых и детей. Количество номеров: В отеле 11 номеров. Типы номеров: — 2-х местный стандарт. Описание номеров: … Читать далее

Рубрики БК Leon (Леон) Метки зеркало, Леон, Леонбет, отзывы, регистрация Оставьте комментарий

Зайти На Сайт Леон Бк

27.06.2023 27.06.2023 от admin

Бонус-коды до 20000 рублей при регистрации в БК Леон Leon ru – один из числа наиболее популярных букмекеров на российском игорном рынке, все еще предоставляет новичкам приятные бонусы. Любой желающий пользоваться услугами БК Леон может получить приветственный фрибет, равен 100 от суммы внесенного депозита. Максимально допустимый бонус при регистрации в БК Леон – это 20.000 … Читать далее

Leonbets Зеркало Новое Zerkalo Leonbets Site Xyz

27.06.2023 27.06.2023 от admin

Приложение БК «Леон» на Андроид: где найти и как использовать Мобильное приложение букмекера открывает дополнительные возможности перед пользователями. Приложение не только удобно в использовании, но еще и гарантирует беттерам получение дополнительных бонусов за установку. Современные беттинг-площадки стараются подстраиваться под требования пользователей, поэтому практически каждый букмекер имеет мобильное приложение. Не является исключением и БК «Леон», с … Читать далее

Бк Леон Русский Сайт

27.06.2023 27.06.2023 от admin

Ленобетс зеркало Букмекерскую контору любят за ряд достоинств. С открытия букмекера прошло более 10 лет, а leon по прежнему предлагает на выбор лучшие варианты бонусных предложений, быструю регистрацию и выгодные коэффициенты. Леонбетс — это международная платформа, которая не работает через ЦУПИС. Организация владеет двумя оффшорными лицензиями, которые гарантируют надежность с 2007 года. Все телефоны службы … Читать далее

Скачать Бк Леонбетс Ставки На Спорт

27.06.2023 27.06.2023 от admin

Leon Как зайти на сайт Зеркало Leon Зеркало Leon Букмекерская контора активно ведет свою деятельность на протяжении многих лет, предоставляя возможность игрокам делать ставки более чем на 25 видов спорта. И все же, независимо от того, что компания ведет свою деятельность легально и имеет соответствующую лицензию, блокировка сайтов букмекера не исключается. Сталкиваясь с подобной проблемой, … Читать далее

Рубрики Сайт Леонбетс официальный Метки БК, Россия, сайт, фортуна, фриспин Оставьте комментарий

Бонусный Баланс Леон Как Обменять Бонусы

27.06.2023 27.06.2023 от admin

Скачать БК Леон Приложение букмекерской конторы Леон имеет тот же функционал, что и официальный сайт компании. В нем можно делать спортивные ставки, узнавать о предстоящих событиях и анализировать результаты прошедших. Из этой статьи вы узнаете, как скачать БК Леон на смартфон или планшет, и на какие особенности стоит обратить внимание. Содержание скрыть Как скачать приложение … Читать далее

Рабочее Зеркало Леон Бетс

27.06.2023 27.06.2023 от admin

Леон ставки на спорт Прельщает интересная бонусная программа данной БК, хотя коэффициенты могли бы быть и выше. Из небольших кэфов следует необходимость забрать выигранное в полном объеме и не делиться еще и с государством. В общем приходиться пользоваться зеркалами и ресурсы подобные этому как раз кстати. Между прочим Леон по-моему единственная из контор, которая о … Читать далее

Бк Леонбетс Официальный Сайт Зеркало Вход Сегодня

27.06.2023 27.06.2023 от admin

Скачать Леон на компьютер Отсканируйте, чтобы скачать Приложение Леон для ПК: последняя версия с официального сайта БК. Скачайте и установите приложение букмекерской конторы Леон бесплатно, чтобы делать ставки на спорт и выигрывать! Букмекерская компания Леон работает на территории России легально, ее официальный сайт находится в доменной зоне “.ru” и не подвержен блокировкам. БК предлагает клиентам … Читать далее

Леон Зеркало Leonbet Zerkalo Ru

27.06.2023 27.06.2023 от admin

Акции и бонусы букмекерской конторы Leon На российском рынке беттинга довольно высокая конкуренция и букмекеры постоянно работают над улучшением сервиса. Расширяется линия спортивных и киберспортивных событий, появляются новые маркеты, улучшается интерфейс сайта и мобильных приложений. Особое внимание в борьбе за аудиторию уделяется бонусной политике. Букмекерская контора Leon часто радует своих клиентов новыми акциями и регулярно … Читать далее

Рубрики Leon ставки на спорт Метки бонус, войти, Леонбет, обзор, Россия Оставьте комментарий

Bk Leon Букмекерская Контора

27.06.2023 27.06.2023 от admin

Обзор приложения Леонбетс на iOS (iPhone) Мобильное приложение букмекерской компании Леон для устройств на iOS, поддерживает главные функции основной версии сайта. Пользователям доступны регистрация, ставки на все события в линии, пополнение баланса, выплата выигрыша. Есть онлайн чат со службой поддержки, поиск по названию матчей, избранное и выкуп пари. Акции и бонусы активны. Как скачать приложение … Читать далее

Рубрики Сайт Леонбетс официальный Метки букмекер, доступ, Леон, сайт, фортуна Оставьте комментарий

Бк Леон Доступ К Сайту Работающее

27.06.2023 27.06.2023 от admin

Leon официальный сайт История букмекерской конторы Leon началась более десятилетия назад. Создатели поставили перед собой амбициозную цель — основать лучшего букмекера, который затмит собой многочисленных конкурентов. Можно сказать, что это удалось. На сегодняшний день компания занимает первые строчки по посещаемости. Каждый день на сайт заходят десятки тысяч человек. Они наслаждаются совершением ставок на спортивные события … Читать далее

Бк Леон Зеркало Сегодня Superkod Space

27.06.2023 27.06.2023 от admin

БК Леон БК Леон!БК Леон. БК Леон!БК Леон. БК Леон.БК Леон!БК Леон. БК Леон!БК Леон! Latest Version Mar 28, 2019 Google Play ID БК Леон APP бк леон букмекерская контора бк леон букмекерская контора бк леон букмекерская контора бк леон букмекерская контора бк леон букмекерская контора бк леон ставки на спорт бк леон ставки на … Читать далее

Рубрики Казино LeonBet Метки зеркало, казино, официальный, регистрация, фриспин Оставьте комментарий

Леон Зеркало Вход Леонбет Зеркало

27.06.2023 27.06.2023 от admin

Бонусы букмекерской конторы Леон Букмекерская компания «Леон» — один из немногих российских букмекеров c бездепозитным фрибетом. Также новым клиентам БК «Леон» предлагает несколько приветственных бонусов в виде фрибетов, а действующие игроки могут принять участие в программе лояльности. Новым игрокам 2 Действующим игрокам 4 Все Фильтровать Используйте фильтры 2 дня 14 ч. Леон: фрибет за ставку … Читать далее

Скачать Леон Бет Зеркало

27.06.2023 27.06.2023 от admin

Служба поддержки Леон Одна из самых современных букмекерских контор Леон имеет один из лучших сайтов среди легальных БК. А как у них обстоит дело со службой поддержки? Разберемся. Букмекерская контора «Леон» начала свою деятельность больше двадцати лет назад — в 1998 году. На сегодняшний день это одна из главных букмекерских контор на российском рынке. БК … Читать далее

Рубрики Казино LeonBet Метки Leonbets, букмекер, выплаты, зеркало, фортуна Оставьте комментарий

Бк Леон Вход Сегодня Бонус Леон

27.06.2023 27.06.2023 от admin

Вывод денег с БК «Леон»: способы и лимиты Подробнее о выводе денег с «Леона», доступных лимитах и нюансах совершения операции, мы расскажем далее. Способы и лимиты вывода средств Для вывода денег БК «Леон» предлагает несколько способов: Банковские карты Visa, MasterCard, МИР. Получить деньги получится на карты, выпущенные российскими банками. Электронные кошельки Qiwi, ЮMoney, ЦУПИС. Банковский … Читать далее

Бк Леон Официальный Зеркало Kontora Leonbets Stavki

27.06.2023 27.06.2023 от admin

Leonbets.net обзор партнерской программы 900+ активных офферов на гемблинг, беттинг, форекс, крипту. Повышенные индивидуальные ставки трастовым вебам! Bilbet Affiliate Bilbet Affiliate Program — прямой рекламодатель в Gambling & Betting вертикали. ГЕО: Индия, Узбекистан. CPA от 30-100$, Revshare: от 40. Букмекерская контора Leon хорошо известна во всем СНГ. Причина тому довольно банальная — мощнейшая маркетинговая деятельность. … Читать далее

Зеркало на сегодня

Рабочее зеркало

Рубрики

- Leon ставки на спорт

- LeonBets зеркало на сегодня

- LeonBets личный кабинет

- БК Leon (Леон)

- Бонус от LeonBets

- Казино LeonBet

- Как получить доступ к сайту Леонбетс?

- Регистрация LeonBets

- Сайт Леонбетс официальный

Свежие записи

- Бк Леон Официальный

- Леон Бонус Новым Игрокам

- Бк Леон Телефон Горячей Линии

- Leonbets Бонус

- Leon Ставки Приложение

- Leonbets Зеркало Рабочее На Сегодня Мобильная Версия

- Бк Леон Актуальное Зеркало Сайта Работающее

- Леон Актуальное Зеркало Леонбетс Зеркало Superkod

- Леон Актуальное Зеркало Superkod

- Леон Букмекерская Контора Бонус При Регистрации

- Леонбетс Зеркало Рабочее На Сегодня Вход

- Леон Зеркало Код Леон

- Леон Ставки Бонус

- Леон Бк Бесплатно

- Leonbets Регистрация Леон Регистрация Рф

- Леон Зеркало Леонбет Официальный Сайт Рф

- Leon Официальный Сайт Ставки

- Леонбетс Регистрация

- Букмекерская Контора Россия Леон

- Leon Зеркало Официальный

- Леон Бетс Com Зеркало Официальный Superkod

- Леонбетс Вход На Сайт

- Bk Леон Зеркало Leonbets Zerkalo Official Xyz

- Leonbets Зеркало Рабочее

- Леон Бк Официальный Сайт Телефон

- Вход На Сайт Букмекерскую Контору Леон

- Leonbets Зеркало Вход Леон Зеркало

- Leonbets Зеркало Зеркало Леон Site

- Леон Бк Зеркало Рабочее Леон Сайт

- Бк Леон Контакты Телефон

- Леон Официальный Сайт Зеркало Вход Сегодня

- Леон Бк Зеркало Рабочее Leon Zerkalo

- Скачать Леон Ставки На Спорт Бесплатно

- Leonbets Com Актуальное Зеркало Мобильная Версия

- Бк Леон Официальный Сайт Вход Сегодня

- Как В Леоне Использовать Бонус

- Зеркало Рабочего Леон Сайта

- Леон Бонус На Первый Депозит

- Рабочее Зеркало Леон Автоматы

- Леон Регистрация

- Бонус Код Леон Фрибет

- Как Заблокировать Леон Бк

- Леонбетс Зеркало Скачать На Андроид Бесплатно

- Leonbets Зеркало Рабочее На Сегодня Ru

- Зеркало Leonbets Leonbets Zerkalo Bk

- Актуальное Зеркало Леонбетс Работающее Леонбетс Зеркало Вход

- Бк Леон Скачать Бесплатно На Телефон

- Бк Леон Фрибет За Регистрацию

- Сегодня Зеркало Леон Вход

- Леон Зеркало Superkod

© 2023 Leonbets слоты онлайн • Создано с помощью GeneratePress

Мы используем куки для наилучшего представления нашего сайта. Если Вы продолжите использовать сайт, мы будем считать что Вас это устраивает. Ok

For anyone else, including MEGA, the data would appear as gibberish, and they would find it impossible to read or understand.

Ключевые слова:

автобус крым москва, билеты на автобусные рейсы, автобусы из крыма, расписание автобусов в москву

Просто на 30 дней. Очень удивлен, так как во многих БК зарегистрирован и активно юзаю, думал сейчас, такой жести уже быть не может.

Пример: если твой первый депозит равен 10 000 руб., то, чтобы активировать бонус, тебе нужно набрать 5 000 леонов.

Важно, чтобы ваш профиль электронного кошелька имел максимальный статус «Профессиональный»

У кого-нибудь выплаты которые были сделаны до тех. Работ пришли или так же еще в обработке. Мош их отменять и по новой заряжать или пусть уже будут. А то тех. Поддержка молчит.

ООО «ЛЕОН» ИНН 9704041169 ОГРН 1207700487169 зарегистрировано 21.12.2020 по адресу 119121, Г.Москва, НАБ САВВИНСКАЯ, Д. 3, ПОДВ. ПОМЕЩ. XVI КОМ. 1 ОФИС 1. Статус компании: действует. Руководителем является: Самохина Анна Анатольевна. Уставный капитал компании: 400000. Основной вид деятельности — Деятельность по оказанию услуг в области бухгалтерского учета, по проведению финансового аудита, по налоговому консультированию. Компания присутствует в реестре Малого и среднего бизнеса как Микро 10.01.2021 состоит на учете в налоговом органе ИНСПЕКЦИЯ ФЕДЕРАЛЬНОЙ НАЛОГОВОЙ СЛУЖБЫ № 4 ПО Г.МОСКВЕ с 21.12.2020. Регистрационный номер в ПФР — 087103173491, в ФСС — 773807185377381