Бк леон номера телефонов

Компания «Леон» входит в пятёрку лучших букмекеров по рейтингу надежности Legalbet и решению спорных ситуаций с игроками. В статье мы расскажем о способах обратной связи со службой поддержки и оценим оперативность ответа операторов.

Как связаться со службой поддержки БК Leon

Саппорт букмекерской конторы Leon работает круглосуточно. Сотрудники компании консультируют клиентов в интерактивном чате и по электронной почте.

Способ №1: Воспользоваться онлайн-чатом

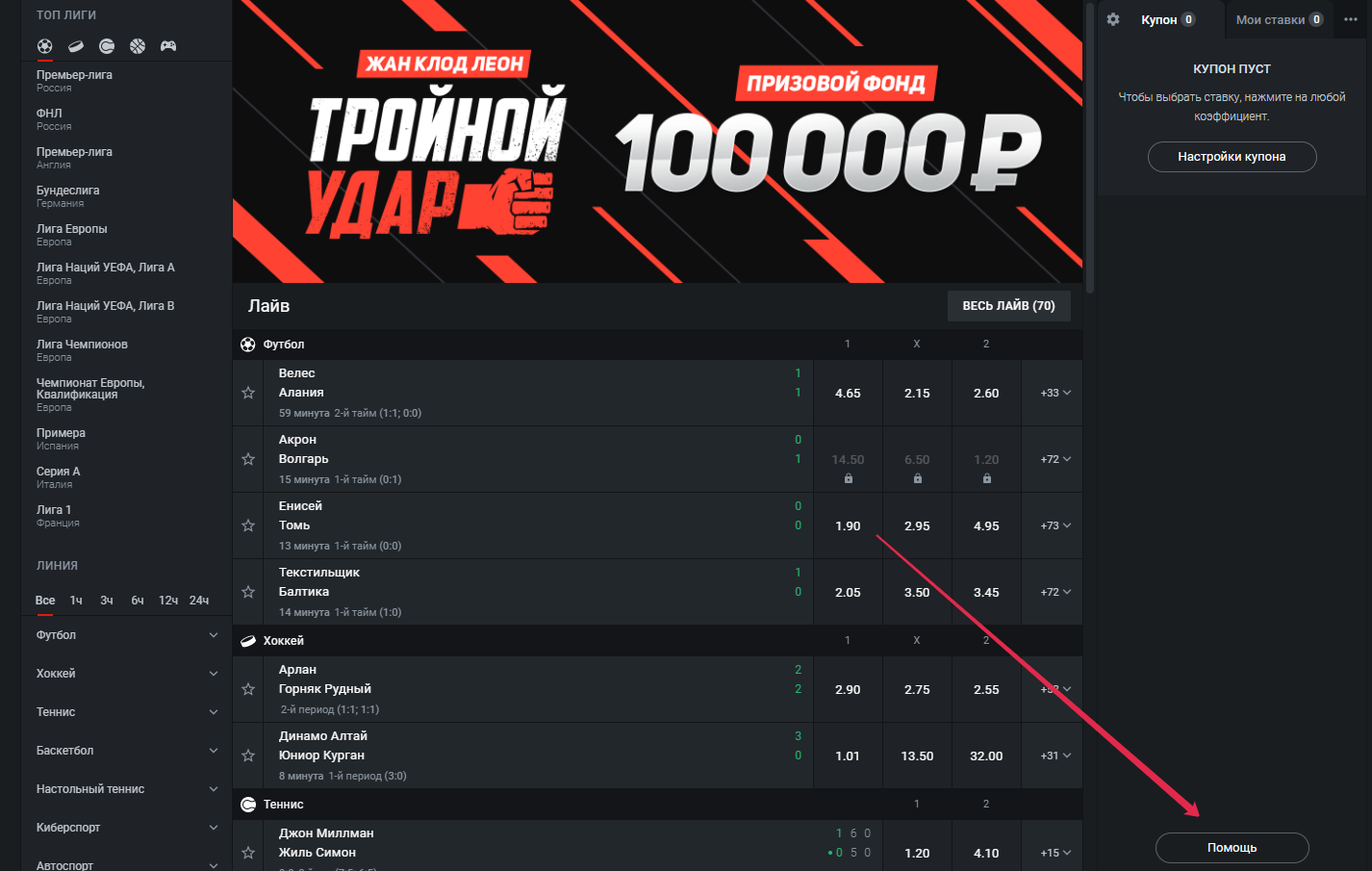

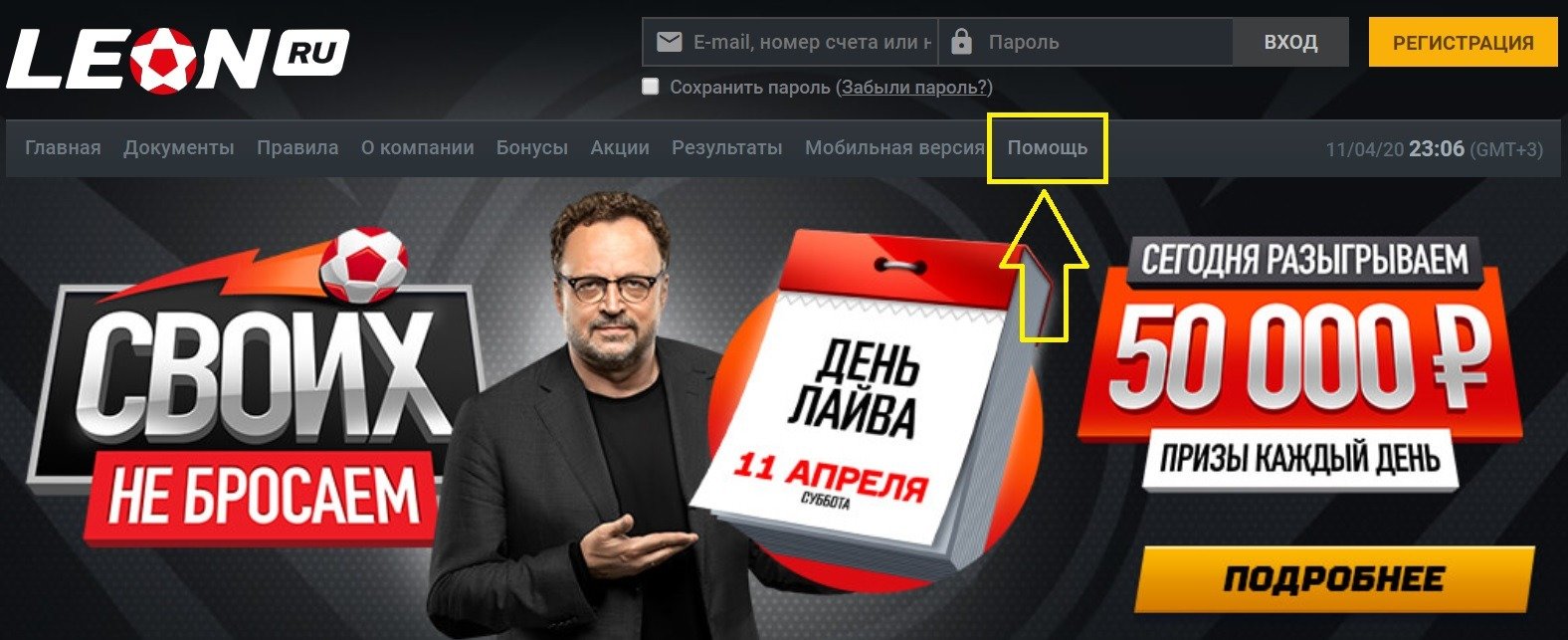

Зарегистрированные пользователи БК «Леон» могут получить ответ на вопрос в интерактивном чате. Для этого необходимо перейти в раздел «Помощь», который располагается в нижней части экрана.

После отправки сообщения оператор подключится к беседе в течение нескольких минут и даст ответы на интересующие вопросы.

Игроки без учетной записи лишены возможности обращения в лайв-чат.

Способ №2: Написать на e-mail

Пользователи без регистрации могут получить консультацию по электронной почте. Есть два e-mail для обращения:

- помощь клиентам: help@leon.ru;

- обратная связь: info@leon.ru.

Ответ на электронный почтовый ящик приходит в течение нескольких часов. Заранее обдумайте формулировку темы и задайте несколько уточняющих вопросов, чтобы разом получить качественную консультацию.

Контакты

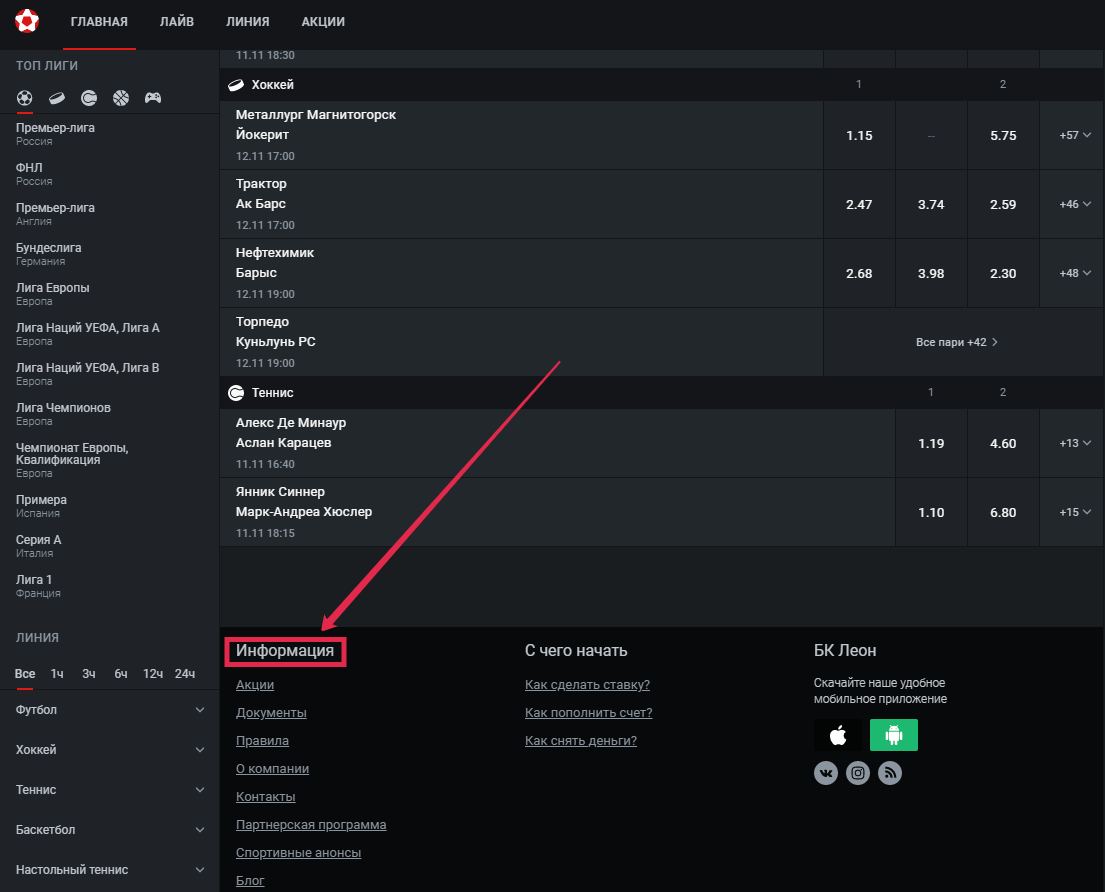

Контакты и дополнительные сведения о букмекере есть в разделе «Информация», который находится внизу страницы.

Информация по конторе Леон

Телефон БК Leon

В отличие от подавляющего большинства легальных букмекеров компания «Леон» не консультирует клиентов по телефону.

Горячая линия — очень удобный способ связи с любой компанией. К сожалению, у Леона подобного варианта общения с клиентами попросту нет. Как же тогда обратиться за помощью? Читайте ниже.

Горячая линия БК Леон

Увы, но вы нигде не найдете номера телефона горячей линии букмекерской конторы Леон. Компания не предоставляет такой вид связи. Соответственно, подобной информации нет нигде: ни на официальном сайте, ни в разделе «Контакты», ни в мобильном приложении, ни где-либо в другом месте. Как следствие, активным игрокам и потенциальным клиентам leon.ru приходится использовать другие методы для решения вопросов, которые возникли в процессе совершения ставок на спорт. К слову, оффшорный букмекер Leonbets находится в аналогичной ситуации. БК не использует классический способ общения через телефон.

Так как же связаться с саппортом БК Леон?

Если кратко, то организация предлагает пользователям два похожих между собой метода:

- Отправить электронное письмо на почту (help@leon.ru или info@leon.ru).

- Написать сообщение, используя форму обратной связи.

Форма обратной связи доступна в разделе «Помощь» главного меню. И в первом, и во втором случаях, принудительная регистрация не нужна. Отправить заявку через обратную связь может даже обычный посетитель сайта.

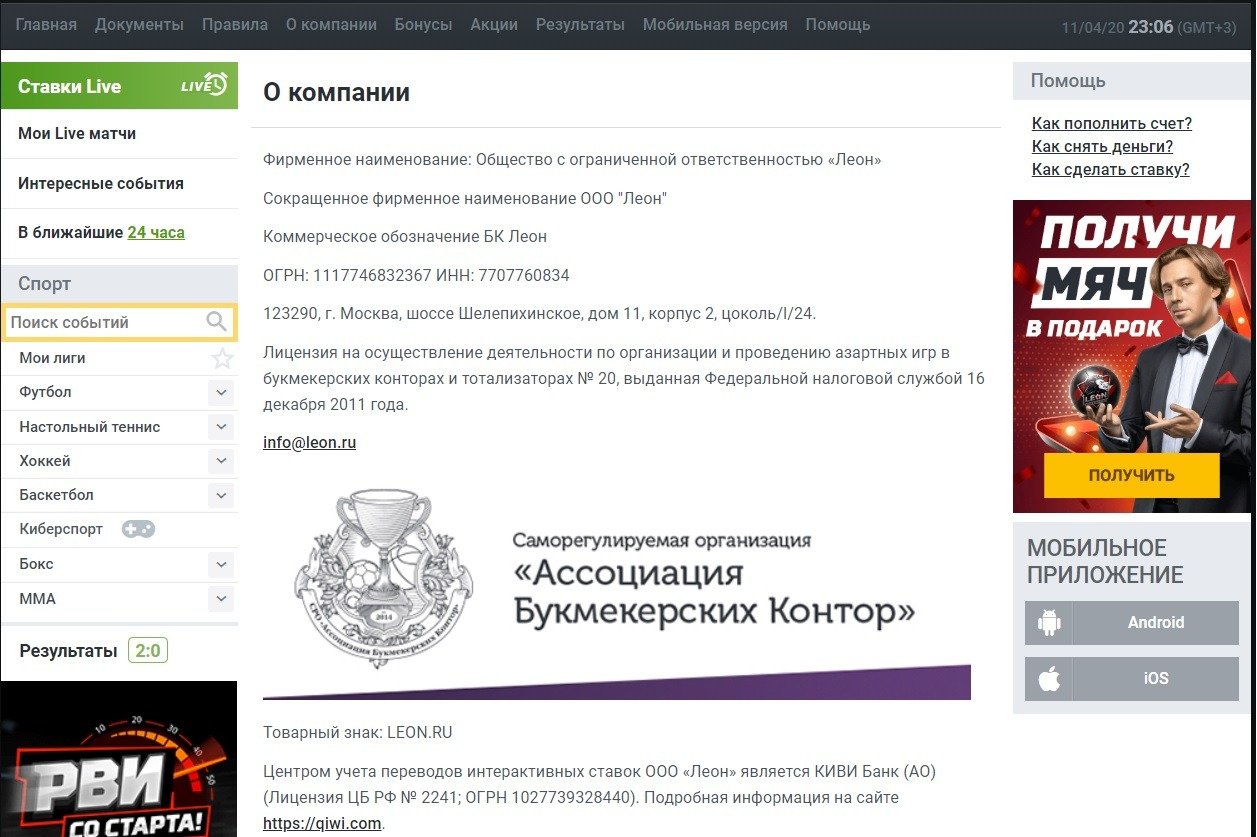

Кроме этого, в Москве размещен офис компании. Адрес, а также другая полезная информация, к примеру, о лицензии, прописана в разделе «О компании».

Резюме

Конечно, хотелось бы больше различных вариантов, которые бы ускорили обработку заявки. К примеру, онлайн чат здесь также не предусмотрен. Будем надеяться, что легальный букмекер в будущем прислушается к беттерам и увеличит количество способов, чтобы обратиться в support официального букмекера РФ. И напоследок, оставляя отзывы в Интернете, игроки не только довольны работой саппорта, но и часто отмечают приятный бонус от букмекера. Напомним, вознаграждения для новых клиентов составляет до 20 000 рублей на первый депозит.

Узнаем, можно ли позвонить по горячей линии Леон? Как написать обращение в службу поддержки? Что известно о компании?

Горячая линия Леон

Служба поддержки реализует программу помощи клиентам только в онлайн виде. На официальном сайте нет информации о горячей линии.

Служба поддержки Леон

Клиенты могут написать в службу поддержки по электронной почте – info@leon.ru (общие темы), help@leon.ru (помощь при регистрации, выводе средств и т.д.).

Кроме этого пользователям открыт отдельный раздел «Помощь», где специалисты стараются оперативно отвечать по обращениям.

Не редко по вопросам пользователей, консультацию проводят через социальные сети:

- ВКонтакте – https://vk.com/leonru_official;

- Youtube – https://www.youtube.com/channel/UCj-zW4RWCcfZQOgPPUnkrHg.

Режим работы

Обратиться в службу поддержки можно ежедневно с 08:00 до 21:00.

О компании

Leon (Леон) — букмекерская компания, ориентированная преимущественно на жителей России. Открыто более 50 филиалов, где игроки смогут сделать ставки.

Работает сайт, при помощи которого можно делать ставки на различные спортивные мероприятия, важные события. Букмекер один из немногих, кто ведет свою деятельность в РФ на легальной основе.

История

Компания была организована ещё в 2007 году. Легальную деятельность начала только в 2011 году, после получения лицензии ФНС.

Долгое время работала исключительно в офф-лайн режиме, принимая ставки только через сеть собственных салонов и партнеров. Сайт с возможностью приема ставок заработал к 2016.

Плюсы и минусы

Плюсы:

- легальная деятельность;

- удобный интерфейс;

- выбор линий;

- приветственные бонусы;

- акции.

Советы эксперта

Эксперт по компаниям и брендам

Получить комментарии и ответы по часто задаваемым вопросам от специалистов букмекерской компании сможете на официальном сайте –

Вопросы и ответы

Для каких случаев нужна служба поддержки?

Обращайтесь в поддержку, если столкнулись с проблемами при регистрации, есть вопросы по верификации аккаунта, хотели бы уточнить условия пополнения счета или вывода средств.

Как зарегистрироваться на сайте?

Для регистрации потребуется активный номер телефона, а также подтверждение личных данных.

Как войти в личный кабинет?

Для входа в личный кабинет переходите по ссылке – https://leon.ru/login. Чтобы войти воспользуйтесь номером телефона, email-адресом или укажите номер счета.

Какие акции проводит компания?

Все акции можно посмотреть на официальном сайте – https://leon.ru/promo. Сроки проведения и условия акций узнавайте у менеджеров.

Как пополнить баланс?

Внести средства на счет можно несколькими способами. Используйте банковский перевод, электронные кошельки или Единый ЦУПИС.

В какой срок деньги зачисляются на счет?

Обычно зачисление средств проходит моментально. Но, если возникают трудности с пополнением, свяжитесь с поддержкой.

Как вывести деньги?

Для вывода средств аналогично воспользуйтесь электронным кошельком, банковским переводом либо Единым ЦУПИС.

Как написать жалобу?

Оставить жалобу можно через форму на сайте, соц. сети или электронную почту. Опишите характер жалобы, укажите данные аккаунта и контакты.

Служба поддержки БК Leonbets: номера телефонов и прочие способы обратиться за помощью

Проблемы с букмекерской конторой Leonbets – это явление, которое встречается нечасто, но иногда возникают ситуации, когда помощь специалиста нужна очень срочно. Поэтому нужно понимать заранее, как обратиться с интересующим вас вопросом к людям, которые смогут дать исчерпывающий ответ.

Служба поддержки Leonbets работает круглосуточно и многие знают лишь номер горячей линии. Но это далеко не все способы связаться с букмекером и задать свой вопрос.

Три способа обратиться в саппорт

Мы подготовили для вас 3 способа связаться со специалистами букмекерской конторы, которые в любое время готовы ответить на интересующий вас вопрос. Беттерам доступны следующие каналы связи:

Телефон горячей линии

Обращение через телефон является самым актуальным способом взаимодействия с букмекерской конторой. На бесплатный номер приходит порядка 70% всех обращений в саппорт.

Чтобы связаться с букмекером достаточно позвонить по номеру: 8-800-333-57-70.

Для ответов на все ваши вопросы подготовьте данные своего аккаунта, а именно:

Все остальные вопросы вам задут специалисты в ходе общения.

Форма обратной связи

Чтобы открыть форму обратной связи, букмекер предлагает три способа:

Откроется дополнительное окно, где надо перейти в раздел «Обратная связь». Там укажите адрес своей электронной почты, категорию вопроса и кратко перескажите всю суть.

Совет: Указывайте полную, достоверную информацию, без эмоциональных украшений. Лучше вы сообщите специалистам суть проблемы, чем расскажете, как сильно вы недовольны. Ответ придет на указанный вами e-mail.

Через электронную почту

Есть два адреса e-mail для связи с технической поддержкой:

Чтобы получить быструю помощь в теле письма сообщите:

Как правило, специалисты отвечают в очень короткий срок на все запросы.

Заключение

Обращение по телефону считается самым быстрым способом взаимодействия с саппортом. Второй по скорости – это обращение на электронную почту. Следом уже идет форма обратной связи. Не забывайте о том, что для связи используются только указанные способы, а сотрудники не просят у вас данные о паролях.

Горячая линия Leon: как связаться с техподдержкой

Компания «Леон» входит в пятёрку лучших букмекеров по рейтингу надежности Legalbet и решению спорных ситуаций с игроками. В статье мы расскажем о способах обратной связи со службой поддержки и оценим оперативность ответа операторов.

Как связаться со службой поддержки БК Leon

Саппорт букмекерской конторы Leon работает круглосуточно. Сотрудники компании консультируют клиентов в интерактивном чате и по электронной почте.

Способ №1: Воспользоваться онлайн-чатом

Зарегистрированные пользователи БК «Леон» могут получить ответ на вопрос в интерактивном чате. Для этого необходимо перейти в раздел «Помощь», который располагается в нижней части экрана.

После отправки сообщения оператор подключится к беседе в течение нескольких минут и даст ответы на интересующие вопросы.

Игроки без учетной записи лишены возможности обращения в лайв-чат.

Способ №2: Написать на e-mail

Пользователи без регистрации могут получить консультацию по электронной почте. Есть два e-mail для обращения:

Ответ на электронный почтовый ящик приходит в течение нескольких часов. Заранее обдумайте формулировку темы и задайте несколько уточняющих вопросов, чтобы разом получить качественную консультацию.

Контакты

Контакты и дополнительные сведения о букмекере есть в разделе «Информация», который находится внизу страницы.

Информация по конторе Леон

Телефон БК Leon

В отличие от подавляющего большинства легальных букмекеров компания «Леон» не консультирует клиентов по телефону.

Телефоны и адреса БК ЛЕОН

Единственный легальный букмекер в России, который не имеет стационарных пунктов приемов ставок в городах, это бк Леон, но у них есть бонусный код для тебя!

Ставки принимаются исключительно на официальном сайте, если регистрируйтесь первый раз не забывайте использовать бонус код: 161213, подробнее о том, как получить бонус 3999 рублей на первый депозит.

Как позвонить в бк леон?

У букмекера Леон нет телефона поддержки игроков.

Если у вас есть вопросы о работе букмекера, выплатах, акциях и т.д. обращайтесь через форму обратной связи на официальном сайте, работают 24/7 и отвечают достаточно оперативно.

после этого выбрать тему и написать свое обращение

Единственный юридический адрес ООО «Леон» это: 123557, г. Москва, пер. Электрический, д. 3/10, стр. 3, комната 3., там не принимают обращения клиентов! Смотрите карту.

Вы должны запомнить, что у Леона НЕТ:

Похожие записи:

то есть с ними никак не связаться, кроме как через обращение на сайте? отправил им фото доков перед выплатой и тишина сутки

получается так, я думаю, что проверка занимает время, потерпите

странно что у такого крупного букмекера нет офиса для клиентов и могли бы себе позволить телефон горячей линии 8-800… типа поддержка, хотя в роде в чате отвечат достаточно быстро, но странно =)

столько денег тратят на рекламу, могли бы телефон поддержки минимум организовать, посадить десяток человек, про офис я вообще молчу, сделайте в крупных городах ППС!

Заблокировали счет,просят скриншот с сайта к киви,где в моих скрытых данных должны высвечиваться первые буквы инициалов в формате Ф******* И** О*******

,Киви объясняет что это информация скрыта,прислала мне документ с печатью о том что номер принадлежит мне,Леон все равно требует этот скриншот,даже не читает мои сообщения,а в формате робота отвечает как попугай,что делать?

А у меня такая ситуация,у меня 550к на счёте лежит,я скинула всё что можно и они запросили верификацию,но я заболела ковидом и пару дней была с очень высокой температурой и мне не до чего было. Я пропустила и мой счёт заблокировали и написали,что надо связаться и в течении 7 дней пройти верификацию,иначе они навсегда заблокируют счёт. И уже 4 дня мне никто не отвечает на почту, я не знаю что делать. Если они заблокируют окончательно, то я пойду в суд, благо у меня все скрины есть. По адресу выше можно досудебное письмо отправлять? Я конечно надеюсь, что они ответят и ситуация разрешится, но походу Леон не любит кому то выплачивать(

Горячая линия Леон

Горячая линия — очень удобный способ связи с любой компанией. К сожалению, у Леона подобного варианта общения с клиентами попросту нет. Как же тогда обратиться за помощью? Читайте ниже.

Горячая линия БК Леон

Увы, но вы нигде не найдете номера телефона горячей линии букмекерской конторы Леон. Компания не предоставляет такой вид связи. Соответственно, подобной информации нет нигде: ни на официальном сайте, ни в разделе «Контакты», ни в мобильном приложении, ни где-либо в другом месте. Как следствие, активным игрокам и потенциальным клиентам leon.ru приходится использовать другие методы для решения вопросов, которые возникли в процессе совершения ставок на спорт. К слову, оффшорный букмекер Leonbets находится в аналогичной ситуации. БК не использует классический способ общения через телефон.

Так как же связаться с саппортом БК Леон?

Если кратко, то организация предлагает пользователям два похожих между собой метода:

Форма обратной связи доступна в разделе «Помощь» главного меню. И в первом, и во втором случаях, принудительная регистрация не нужна. Отправить заявку через обратную связь может даже обычный посетитель сайта.

Кроме этого, в Москве размещен офис компании. Адрес, а также другая полезная информация, к примеру, о лицензии, прописана в разделе «О компании».

Резюме

Конечно, хотелось бы больше различных вариантов, которые бы ускорили обработку заявки. К примеру, онлайн чат здесь также не предусмотрен. Будем надеяться, что легальный букмекер в будущем прислушается к беттерам и увеличит количество способов, чтобы обратиться в support официального букмекера РФ. И напоследок, оставляя отзывы в Интернете, игроки не только довольны работой саппорта, но и часто отмечают приятный бонус от букмекера. Напомним, вознаграждения для новых клиентов составляет до 20 000 рублей на первый депозит.

БК Леон: горячая линия и служба поддержки

Обновлено 28 мая 2021

Компания Leon легально работает в России (входит в СРО букмекеров), поэтому общается с клиентами техподдержка букмекерской конторы только на русском. В БК Леон горячая линия функционирует ежедневно 24 часа в сутки без выходных.

Онлайн-чат

Общаться в режиме реального времени с оператором службы поддержки Леонбет можно на официальном сайте конторы.

Необходимо авторизоваться и на главной странице в правом нижнем углу нажать кнопку «Помощь»(Help).

Появится новая вкладка, где нужно выбрать «Онлайн-чат».

В правом нижнем углу появится окно, где пользователь может задать вопрос или изложить условия проблемной ситуации, с которой столкнулся при сотрудничестве с данным букмекером. При необходимости можно прикрепить скриншот.

Через несколько минут оператор техподдержки подключится в чат онлайн и будет помогать игроку решать вопрос.

Форма обратной связи

Процесс идентичен способу выше. Нужно авторизоваться и нажать в правом нижнем углу кнопку «Помощь». В новом окне выбрать «Электронная почта».

В открывшейся форме потребуется указать e-mail для связи, выбрать тему запроса и написать вопрос.

Отметим, что обращаться за помощью в Leonbet также можно, написав письмо на адрес электронной почты.

Обращение в поддержку с мобильного телефона

Способы связи с технической поддержкой с помощью мобильного телефона идентичные. Нужно входить в аккаунт в мобильной версии или приложения, а затем задавать необходимый вопрос в онлайн-чате или в форме обратной связи.

Рассмотрим данный процесс подробнее в приложении.

Потребуется зайти в меню, а затем в раздел «Контакты».

В открывшемся окне появится форма обратной связи, где нужно выбрать тему запроса и задать возникший вопрос.

Если требуется получить ответ быстро, то рекомендуется воспользоваться онлайн-чатом. Необходимо кликнуть в главном меню страницы на значок сообщения, затем откроется переписка с оператором.

Техническая поддержка работает круглосуточно семь дней в неделю в 2021 году. Как только беттор задаст вопрос, то в течение нескольких минут сотрудник будет связываться с ним и отвечать на спорный вопрос.

Часто задаваемые вопросы

Можно ли обращаться в техническую поддержку российской конторы БК Леон без верификации?

Да, конечно. Потребуется только регистрация и авторизация, затем появится возможность обратиться в саппорт за помощью.

Отметим, что без идентификации личности в конторах, ведущих деятельность по лицензии и состоящих в ассоциации букмекеров РФ, сегодня нельзя делать интерактивные ставки на спорт и киберспорт.

Почему в БК Леон недоступна горячая линия по телефону?

В букмекерской конторе связаться с техподдержкой можно только двумя указанными выше способами. Почему горячая телефонная линия недоступна неизвестно.

Предоставляет ли Леонбет приветственный бонус?

Да, при пополнении первого депозита игрок может получить до 20 тысяч бонусных рублей. На эти деньги можно играть, находить привлекательные события и заключать пари на хорошие коэффициенты.

Акция бесплатная и принимать участие может каждый новичок. Подробное описание бонусной программы доступно на официальном сайте конторы. Если появятся вопросы, то можно обратиться за помощью в контактный центр Леонбет.

Подпишитесь на новостную рассылку

Одно письмо с лучшими материалами за неделю. Подписывайтесь, чтобы ничего не упустить.

Спасибо!

Мы получили ваши данные

В ближайшее время вы получите на почту свежие новости от Fanler

Просто крутит,а не заходит

После того, как число бонусных баллов доходит до 10000, а деньги поступили на счёт, их можно, как продолжать ставить, так и вывести с баланса игрового счёта.

Мобильная версия сайта leon.ru — альтернатива использованию приложений для тех, кто привык ставить со смартфона. В ней есть весь функционал полной версии сайта, за исключением раздела «Результаты».

Регистрация состоит из нескольких этапов.

Стоит отметить, что у Leonbet, есть международная версия сайта, работа которой запрещена в России. Структура этого веб-ресурса немного отличается от легальной букмекерской конторы, например, в нелегальном букмекере игрокам доступно казино, игровые автоматы и TV игры. Дизайн сайтов при этом одинаковый.

Характеристики:

На игровой платформе предусмотрены условия, которые необходимо выполнить, чтобы бонусные средства перевелись на основной счёт:

Размер бездепозитного бонуса в БК Леон составляет 500 рублей, а получить его можно только в мобильном приложении букмекера

Читайте вместе с ищут: