Почему не работает сайт БК Леон

Leon – российская организация, что ведет деятельность в РФ легально. Но наличие лицензии не гарантирует стабильную работу сервисов. Поэтому беттерам полезно знать, что делать, если приложение или сайт букмекерской конторы «Леон» не открывается .

Почему возникают неполадки

В 2023 много причин, почему не работает сайт букмекера , но стоит искать в двух направлениях:

- Неполадки со стороны легальной, с лицензией букмекерской конторы «Леон» (это подтверждает отсутствие офшорных счетов — деятельность в РФ официальная) самостоятельно устранить не получится. Нужно связаться с сотрудниками службы поддержки и сообщить о проблеме.

- Трудностей у клиентов бывает много, поэтому придется искать неисправность поэтапно — исключая варианты, которые не приносят результат.

Важно! Если другие сайты не блокируются, вероятно, доступ и возможность заключить пари скоро восстановят , ведь это проблема на стороне сервиса и работники о ней знают. Нужно только дать им время .

Глюки приложения

Сбои софта Леон в работе редки, но возникают по ряду причин:

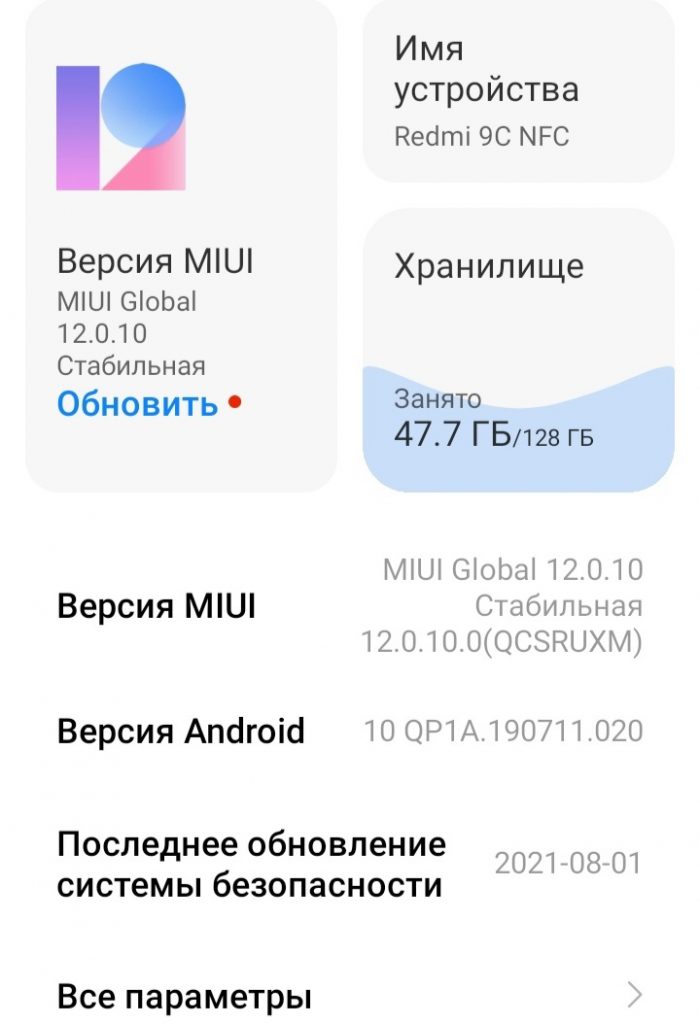

- Нет памяти на смартфоне. Для стабильной работы приложения телефон должен иметь много свободного места.

- Версия софта не подходит ОС. Смартфон старый и его операционная система давно не обновлялась. Это еще одна причина , почему не работает сайт букмекера или программа букмекерской конторы в 2023 . Пользователь может зайти в соцсети, чтобы узнать у службы поддержки и проверить требования, чтобы попробовать установить обновление.

- Забит кэш браузера. Пользователю лучше проверить связь интернет-соединения . Возможно, это ошибка или проблема на стороне провайдер а.

Подобные проблемы могут возникнуть из-за технических неполадок приложения. Работа сервиса восстановится, когда российский букмекер «Леон» обнаружит и устранит сбой.

Проблемы у пользователя

Беттеру следует проверить интернет-соединение и правильность введенного адреса БК «Леон». Это банальное действие часто помогает снять блокировку , пройти регистрацию и заключить пари на матч . Другие ошибки и неисправности тоже исправить не составит труда, если следовать рекомендациям.

Проверка настройки времени и даты

На leon.ru в России используют протокол https. Потому сервис глючит и не работает, когда на устройстве беттера время установлено неправильно. Нужные параметры можно изменить в меню «Настройки».

Решение подходит для компьютер а и мобильного приложения «Леон».

Перезагрузка модема и устройства

Помимо сервиса букмекерской конторы недоступны и иные ресурс ы, тогда дело в провайдер е или настройках интернет-соединения. Перед тем как восстановить leon.ru , нужно перезагрузить сетевой роутер, телефон или ПК.

Способ подойдет для сайта букмекерской конторы «Леон» и официального приложения фирмы.

Очистка кеша

Подобную процедуру проводят примерно по одному алгоритму:

- Зайти в «Настройки», используя меню сбоку экрана.

- Выбрать раздел «Конфиденциальность».

- Щелкнуть кнопку «Очистить историю».

- Должно открыться окно, где требуется выбрать предложенные варианты для удаления — переходы по ссылкам , файлы данных ( cookie ). Останется щелкнуть по клавише «Удалить данные».

Потом желательно попробовать перезагрузить браузер. Возможно, придется ждать дольше обычного при первом переходе после очистки cookie и кэш а — пока не пройдет полная загрузка контента ( значит , что начнется поиск нужных элементов с сервера).

Этот способ подходит для решения проблем с сайтом БК Леон и приложением.

Смена устройства и соединения

Если приложение «Леона» не работает, клиент у нужно использовать другой ПК или ноутбук, сетевой роутер или модем, мобильный телефон. Метод прост, но эффективен. Возможно, выбранный смартфон или компьютер несовместим с сервером букмекерской конторы из-за устаревших параметров со стороны беттера.

Установка приложения

Пока leon.ru заблокирован, можно загрузить специальное приложение. Контора выпустила утилиту для iOS и Android. Загрузка бесплатная и не отнимет больше трех минут.

Важно! Если букмекер «Леон» остается недоступным после использования всех описанных методов решения, то неисправность на стороне компании. И нет смысла продолжать искать поломки на телефоне или персональном компьютере. Клиент у стоит попробовать написать в службу поддержки .

Неисправность у букмекера

Вывод : если беттер уверен, что приложение БК «Леон» не открывается или не работает из-за проблем разработчика, нужно сообщить об этом службе техподдержки через leon.ru . А когда сервис не открывается и написать администрации нельзя, значит , остается связь по e-mail — help@leon ru. Желательно прикрепить к сообщению скриншоты экрана, где четко видна проблема. Так сотрудники быстрее выяснят причину и сразу же отреагируют на запрос.

Не всегда стоит поднимать панику, когда не можешь зайти на сервис, сделать ставку на матч и заработать деньги — иногда разработчики портала проводят технические работы, чтобы улучшить возможности сайта. Вывод в том, что требуется просто дать время и немного подождать , а потом повторно набрать URL-адрес компании. Также не рекомендуют входить на сервис сайта БК через VPN и «зеркала». Блокировка ресурс а из-за санкций в России исключена .

В период акции, клиенты вправе воспользоваться предложением до 4-х раз.

Ближайший городской пляж в 10 минутах ходьбы от отеля имеет песчано-галечное покрытие и расположен рядом с эвкалиптовой рощей.

После выполнения вышеперечисленных условий вы получите фрибет в размере 1000 рублей.

Работающее зеркало сайта сегодня не актуально, так как БК «Леон» легальна в России. Компания даёт бонус новым клиентам на 100% от первого депозита, но не более 20 000 рублей. В линии букмекера широкий выбор событий, включая киберспорт и долгосрочные ставки.